On a day that appears will be an ok one for the equity market overall, AVID is taking a big dump. While the S&P 500 futures is up 0.5%, AVID shares are sliding, down almost 15%. It could get worse as the Company announced it has to postpone its Q4 earnings announcement (originally scheduled to be released tomorrow after the close) to evaluate its current and historical accounting treatment related to bug fixes, upgrades and enhancements to certain products that it sold to some clients. It came across this during its normal review of Q4 and FY '12 financial results. Unfortunately, the Company does not yet know when it will finish such review and release its Q4 results.

Monday, February 25, 2013

Tuesday, February 19, 2013

Thursday, February 14, 2013

Jan. Industrial Production and Capacity Utilization Expectations

Industrial production and capacity utilization for January will be released tomorrow morning at 10am (ET). Given the surprising upside that we saw in Jan. ISM-manufacturing index, we think industrial production may come in slightly ahead of expectations. Our estimate is 98.5%, a 0.4% increase from Dec. The consensus stands at 98.4%. With not much overall change in the work week figures of most regional surveys, we think capacity utilization will likely be in-line with the Street's estimate of 78.9%, a 0.1% sequential increase.

Investors Must Lower Their Expectations for Returns: Arnott

We found the article/video, Investors Must Lower Their Expectations for Returns: Arnott, on Yahoo! Finance. Mr. Arnott is basically saying what we have been trying to say the last few years. Unfortunately, the QE policies do not allow individuals and investors to save. Those policies basically force them to take much more risk, especially given the stagnation of wage growth, with not nearly as much potential additional return. The video and article can be accessed here: http://finance.yahoo.com/blogs/breakout/investors-must-lower-expectations-arnott-122138715.html

Wednesday, February 13, 2013

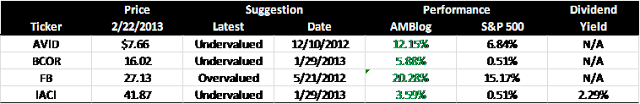

BCOR: Strong Q4 Results; Guidance Ahead of Expectations

Blucora (BCOR), the company we suggested on 1/29, reported strong Q4 numbers and provided Q1 guidance well ahead of consensus. The Company also announced a $50MM share buy-back program over the next 24 months; which we view as positive. Based on where it closed on Wednesday, BCOR is trading at a mere 6x total FY '13 EBITDA. The stock has reacted well to the Q4 earnings release as it was up nearly 10% in AH, at $16.54. Whether this upturn will continue throughout the day on Thursday remains to be seen. As a reminder, our valuation of the company is $19/sh.

- Total Q4 revenues came in at $97.47MM, up 46.3% Y/Y, driven mainly by 44.6% growth in the Search segment. Not surprisingly, revenues from the Tax Preparation segment in Q4, the seasonally weakest quarter, came in at only $1.17MM. For the year, top-line growth was 77.8% driven not only by the acquisition of TaxAct, but also a 50.7% growth in the Search segment.

- Search segment EBITDA margin for the quarter was 18.0%, slightly lower than the 19.2% in Q4 '11. This was mainly due to a higher portion of revenues, with lower margins, coming from distribution partners.

- Initially we were a bit too conservative as we thought that such trend in BCOR's Search revenues, in addition to changes enforced by Google (GOOG), would drive EBITDA margin to 15% in FY '13. However, based on management's guidance, it appears that management believes Search segment income margin will bottom out at slightly above 16%. We expect that BCOR's and other players' adaptation to GOOG standards over time will lead to margin expansion again, likely in late Q4 and continuing into FY '14. However, given the expected volatility surrounding this space, we stand by our 15% assumption for FY '13, which, again, appears to be very conservative.

- As expected, the Tax Preparation segment generated losses in the quarter. However, for the year, that segment's income margin was an impressive 48.4%. Management's guidance for 1H '13 indicates EBITDA margin of 52%. While we have confidence that the Company can achieve this, we believe margin for the year will be slightly lower, likely around 49%, due to expected losses in Q3 and Q4. We note that given the new services being rolled out in that segment, revenues in 2H '13 may be higher, possibly reducing losses compared to those incurred in FY '12.

We have not changed any of our assumptions or estimates as we continue to view BCOR as a value-play.

We still expect top-line growth of 12.5% in Search for the year, which is in-line with what management guided this afternoon - "low double digit" growth. As mentioned earlier, our Search EBITDA estimate is below management's guidance, but we're sticking with it given the volatility in that space. So we estimate $387.9MM and $58.2MM for FY '13 Search revenues and EBITDA, respectively. Based on management's guidance, the Street will likely be expecting EBITDA of around $64MM - $65MM for Search.

We estimate $90.5MM in FY '13 revenues for Tax Preparation, which could generate approx. $44MM in EBITDA.

Our sum-of-parts valuation, which consists of 6x Search EBITDA, 8x Tax Preparation EBITDA, plus net cash of approx. $88MM, results in a market cap of $790MM or nearly $19/sh. This represents a forward EV/EBITDA multiple of only 7.9 for the entire company, which we think will include around $13MM in unallocated corp. expenses in FY '13.

We still expect top-line growth of 12.5% in Search for the year, which is in-line with what management guided this afternoon - "low double digit" growth. As mentioned earlier, our Search EBITDA estimate is below management's guidance, but we're sticking with it given the volatility in that space. So we estimate $387.9MM and $58.2MM for FY '13 Search revenues and EBITDA, respectively. Based on management's guidance, the Street will likely be expecting EBITDA of around $64MM - $65MM for Search.

We estimate $90.5MM in FY '13 revenues for Tax Preparation, which could generate approx. $44MM in EBITDA.

Our sum-of-parts valuation, which consists of 6x Search EBITDA, 8x Tax Preparation EBITDA, plus net cash of approx. $88MM, results in a market cap of $790MM or nearly $19/sh. This represents a forward EV/EBITDA multiple of only 7.9 for the entire company, which we think will include around $13MM in unallocated corp. expenses in FY '13.

Tuesday, February 12, 2013

Facebook (FB) Cut by Bernstein to Market Perform

According to Forbes, Bernstein downgraded Facebook (FB) to market-perform after the close on Monday (2/11). It reduced its FB valuation to $27/sh from $33/sh. The article can be accessed directly from here: http://www.forbes.com/sites/ericsavitz/2013/02/11/feeling-asocial-bernstein-cuts-facebook-to-market-perform/

We note that a couple of the concerns that we mentioned at the end of Jan. were included in Bernstein's analysis on Monday: early 'impressive' growth in mobile ad revenues could be misleading; there is evidence of continuing pricing pressure from mere modest growth in price per ads even though the FB platform for ads is hyped as the one with highest potential return; and lack of enough evidence that revenues and profitability from emerging markets will grow fast enough to at least partially offset what appears to be not significant enough growth in the developed markets (North America and Europe).

Lastly, although it is considered 'old news', Stifel Nicolaus downgraded FB on 1/31.

Monday, February 11, 2013

AVID Names Louis Hernandez CEO

Avid Technology (AVID) announced this morning that Louis Hernandez, a Board member since 2008 and CEO of Open Solutions which was acquired by Fiserv last month, will be the Company's new CEO, replacing Gary Greenfield. Mr. Greenfield will stay on AVID's Board of Directors. We are not sure whether or not the timing of this announcement has anything to do with AVID's Q4 earnings results (due out on 2/26). However, given that Mr. Hernandez's previous company was acquired just recently, it appears the Board had been considering a change at the top for some time.

The stock reacted well to the news as it closed at $7.87, up 4.5% for the day. Lastly, we found a full and impressive bio of Mr. Hernandez on Open Solutions' website - http://www.opensolutions.com/about-us/executive-team/Louis_Hernandez_Jr.aspx

Thursday, February 7, 2013

IACI: Solid Q4 Results and Strong FY '13 Guidance

IAC/InterActiveCorp (IACI) reported what we believe was a strong Q4 '12. Management's confidence going forward was evident, as for the first time the Company provided more color or guidance regarding how it expects to perform in FY '13. We now value IACI at $52.00/sh. Our valuation of the Company is $0.50/sh lower mainly due to a higher share count as of the end of FY '12. Given our conservative 15% FY '13 top-line growth projection, which we think will result in margin expansion and EBITDA Y/Y growth of 28%, we are applying an EV/EBITDA of 7.5, slightly higher than the 7.0 that we mentioned in our first post. The stock had moved up approx. 6% since we mentioned it eight days ago. After the release of Q4 results, shares of IACI were down only a penny in AH trading. With quarterly dividends of $0.24/sh, IACI's dividend yield is 2.23%, which makes the stock more attractive and more of a value play.

- Total Q4 revenues of $765.3MM, which represented Y/Y and Q/Q growth of 28.1% and 7.1%, respectively, were above the Street's $758.1MM expectation. FY '12 revenues of $2,800.9MM were up 36% Y/Y.

- Q4 GAAP EPS of $0.40; adj. EPS of $0.70. Adj. EPS were below the Street's $0.78 for two reasons: 1) $11.5MM in restructuring charges, and 2) effective tax rate of 41% compared to 35% in the model. Although restructuring charges were unexpected, we do consider them as part of operations as they are not related to any discontinued operations. GAAP and adjusted EPS, including the restructuring charges but with a 35% tax rate, would have been $0.52 and $0.78, respectively; in-line with expectations. Of course, if one decides to exclude those restructuring charges from the adj. net income calculation, IACI's adj. EPS would be much higher.

- Adj. EBITDA (excl. non-cash compensation expense) for the year were $497.3MM, up 36% Y/Y. As a percentage of revenues, EBITDA remained flat compared to FY '11. Again, we think EBITDA margin will expand in FY '13. Such expansion will be driven mainly by higher margin in Match and significantly lower operating loss in Media & Other. We expect the Company to successfully cross-sell and up-sell more revenue generating services at lower costs to its current and future Match users going forward.

- Management stated it will continue its share buy-back program, if necessary. Between Oct. '12 and Feb. '13, it bought back 6.4MM shares at an average price of $45.69.

- In terms of FY '13 guidance, management expects "double-digit" revenue and operating income before amortization (OIBA) growth within the Search & Applications segment; "low double-digit" revenue and "high double-digit" OIBA growth in Match; "modest double-digit" revenue and OIBA growth in Local; and "solid double-digit" revenue growth accompanied by OIBA loss of $25MM - $30MM in Media & Other segment. Again, this was guidance for the full year.

- Q1 will likely be the weakest quarter. For example, approx. 40% of Media & Other's full-year expected OIBA loss will be in Q1. In addition, Search & Applications revenue growth will be stronger in Q2 - Q4 than what is expected in Q1.

- We believe interpretation of management's 'guidance' will vary. We did not make significant changes to our projections. For FY '13 we expect revenues of $3,212.0MM and adj. EBITDA of $636.0MM, or Y/Y growth rates of 15% and 28%, respectively.

Overall, we think IACI reported a solid Q4 and we remain confident regarding its performance in FY '13. Surprisingly, this was supported by management providing guidance for the first time on the earnings call. Our conservative valuation represents a 22% upside from where the stock closed at on Wednesday. Lastly, given the average price at which the Company repurchased its shares the last time around, the share buyback program could provide a floor at $35 - $40 per share, limiting the downside a bit.

Monday, February 4, 2013

January NFP & Mfr. ISM ...

Well, we certainly cannot claim "accuracy" to be our middle name when it comes to projecting the latest macro indicators. On Friday, January NFP came in below our estimate while ISM manufacturing blew away our what appeared to be a pessimistic type of projection.

The state of employment report for January included NFP change of +157K and the official unemployment rate of 7.9%. NFP was 18K below our estimate and the Street's. We must say that given the prior two months' significant upward revisions, our NFP estimate cannot necessarily be thought of as too optimistic. November and December NFP counts were revised up by 86K and 41K, respectively. However, as we noted last week, based on the late January initial jobless claims data, we could see a slowdown in or reversal of NFP's last few months' upward trend.

January manufacturing ISM of 53.1 certainly surpassed the Street's 50.7 and our 49.0 estimates. This was driven mainly by growth in new orders and inventories. The employment sub-index also ticked up a bit. In fact, this sub-index has been increasing for the past 40 months. Given further contraction in backlog of orders and continuing increase in customers' inventories (although not significant), we do not expect such positive impact from the inventories sub-index in the February numbers.

The week of 2/4 appears to be a bit light compared to the prior week. The only market moving macro indicators scheduled to be released are the non-manufacturing ISM (2/5) and weekly initial jobless claims (2/7).

Lastly, congrats to the Super Bowl 2013 champions, the Baltimore Ravens. We just hope the Jets will get at least an average QB one day so they could have a chance to accomplish what the Ravens just did.

The state of employment report for January included NFP change of +157K and the official unemployment rate of 7.9%. NFP was 18K below our estimate and the Street's. We must say that given the prior two months' significant upward revisions, our NFP estimate cannot necessarily be thought of as too optimistic. November and December NFP counts were revised up by 86K and 41K, respectively. However, as we noted last week, based on the late January initial jobless claims data, we could see a slowdown in or reversal of NFP's last few months' upward trend.

January manufacturing ISM of 53.1 certainly surpassed the Street's 50.7 and our 49.0 estimates. This was driven mainly by growth in new orders and inventories. The employment sub-index also ticked up a bit. In fact, this sub-index has been increasing for the past 40 months. Given further contraction in backlog of orders and continuing increase in customers' inventories (although not significant), we do not expect such positive impact from the inventories sub-index in the February numbers.

The week of 2/4 appears to be a bit light compared to the prior week. The only market moving macro indicators scheduled to be released are the non-manufacturing ISM (2/5) and weekly initial jobless claims (2/7).

Lastly, congrats to the Super Bowl 2013 champions, the Baltimore Ravens. We just hope the Jets will get at least an average QB one day so they could have a chance to accomplish what the Ravens just did.

Subscribe to:

Posts (Atom)