As if things could not get any worse for AVID, one of the stocks that we valued around $9/sh, the Company filed an 8-K on Friday saying that Nasdaq's Listing Qualifications Department notified it of a possible delisting. This was due to AVID not filing its 10-K on time, for which the deadline was March 18. This was expected but the stock continued its decline. Besides the 8-K, the Company has not provided any additional information on any progress made in the review and evaluation of revenue recognition of some of its services.

If there is anything positive about this stock right now, it is that while declining, its volume has also been declining a bit. We also note that the stock still has not reached its 52-week low of $5.85. If the Company finally files its 10-K before the May 20 deadline, depending on the outcome of its accounting review, the stock could move significantly higher or lower (yes, this sounded just like a regular broker). With this in mind, a May or June $7.50/$5.00 strangle may work. We were certainly pleased when the stock hit $8.00 on Valentine's Day, up 17%+ since we initially discussed it. But again, there has been nothing but negative news since then. With a 'glass is half-full' mentality (not necessarily recommended at this point), one could still hope that given the decline in the stock, the Company could get acquired and/or taken private. The new CEO, Louis Hernandez Jr., did sell his last company, Open Solutions, to Fiserv (FISV). Then again, what a CEO has done in the past does not always indicate what he's capable of doing going forward. This was certainly the case with AVID's last CEO, the so-called 'turnaround CEO', Mr. Gary Greenfield. Going back to the hope of getting acquired, the premium (if any) in an acquisition price (if any) is still dependent on the outcome of AVID's accounting review.

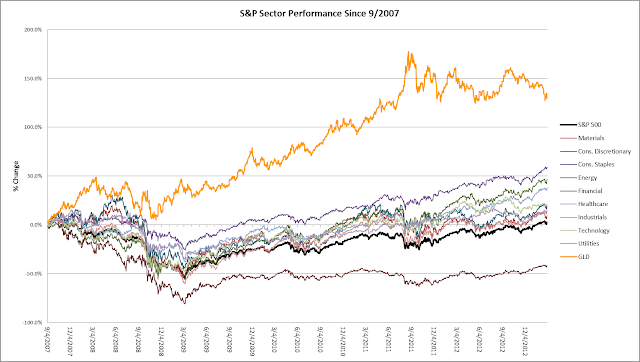

While AVID has been a disappointment, the other names have done ok compared to our benchmark, S&P 500.

It appears that a bailout deal regarding Cyprus has been reached. Then again, we think there is still a potential of the 'contagion effect' once the Cyprus banks actually open. They have been closed for a week as the government feared many people would quickly take out their cash to avoid the bank levy proposition 'offered' last week. Some believe the banks will re-open on Tuesday. It remains to be seen whether that fear in many bank account holders has been reduced or not. Fear and/or frustration in Cyprus became apparent after an explosion at one of Bank of Cyprus branches on Sunday. Various reports say that the explosion was very small, and thankfully no one was hurt. But again, it does indicate increasing anger which could spread to other parts of Cyprus and the Eurozone.

The latest bailout deal has pushed the S&P 500 futures up around 0.40% indicating stocks will likely be up when the market opens on Monday.