Friday, May 24, 2013

Thursday, May 23, 2013

It's early, but FYI, equity futures down approx. 1% ...

It appears that the market needs either better economic data or further confirmation or assurance that it will remain centrally managed and controlled by Bernanke and the Fed. Mr. Bernanke's testimony on Wednesday was not as effective as many had expected. We find it interesting that while the Fed is trying to be as transparent as possible regarding how it is managing this supposed free market and economy, it is also trying not to be too transparent to make sure everyone still believes that this is a free market and economy! All of this has gotten the market more and more addicted to the Fed's QE. At times it appears that the market, lawmakers, entertainment/business TV networks, and everyone else are saying what Cypress Hill used to sing in the early 1990's: "I want to get high, so high ...". (http://www.youtube.com/watch?v=cXQ0CyZpmZo)

We note that the equity market no longer reacts as significantly to positive or negative macro news as it did the last few years, which means there are some companies that remain undervalued and/or under-followed. However, in the meantime, as the market has kept hitting new highs, a pullback, basically of any significance, has become more likely.

S&P 500 futures are down around 1% right now. And on the global front, the Asian markets are taking a hit mainly due to the disappointing Bernanke testimony and decline in China's preliminary manufacturing index for the month of May. Japan's NIKKEI 225 index is down 7%. Then again, it had skyrocketed 45%+ from the beginning of the year.

Things don't look that great from a technical standpoint. After spiking up nearly 6% in less than a month and hitting the all-time high of 1687.18, S&P 500 has a huge gap to fill. Its next support level, we think, is around 1595, which is also its next Fibonacci Retracement level and where the linear regression line is currently hitting. If it goes below that, which the Fed and lawmakers will do their best to prevent from happening, then 1540 would be the next support level. In terms of MACD (moving average convergence/divergence), it went as high as 25.1 and ended Wednesday at 24.1. Last time the MACD value hit that level was in late Oct. '11, after which the market experienced a near 10% pullback.

Of course, potential losses within the US equity market could be pared or avoided if Thursday's initial jobless claims and new home sales numbers come in much better than expected. The consensus for initial claims is 345K, while economists expect April's new home sales to have edged up slightly to 425K, from March's 417K.

S&P 500 futures are down around 1% right now. And on the global front, the Asian markets are taking a hit mainly due to the disappointing Bernanke testimony and decline in China's preliminary manufacturing index for the month of May. Japan's NIKKEI 225 index is down 7%. Then again, it had skyrocketed 45%+ from the beginning of the year.

Things don't look that great from a technical standpoint. After spiking up nearly 6% in less than a month and hitting the all-time high of 1687.18, S&P 500 has a huge gap to fill. Its next support level, we think, is around 1595, which is also its next Fibonacci Retracement level and where the linear regression line is currently hitting. If it goes below that, which the Fed and lawmakers will do their best to prevent from happening, then 1540 would be the next support level. In terms of MACD (moving average convergence/divergence), it went as high as 25.1 and ended Wednesday at 24.1. Last time the MACD value hit that level was in late Oct. '11, after which the market experienced a near 10% pullback.

Of course, potential losses within the US equity market could be pared or avoided if Thursday's initial jobless claims and new home sales numbers come in much better than expected. The consensus for initial claims is 345K, while economists expect April's new home sales to have edged up slightly to 425K, from March's 417K.

Wednesday, May 22, 2013

AVID: Received a second letter from NASDAQ

Avid (AVID) received a second letter from NASDAQ basically warning the Company again that it has not filed its quarterly and annual reports on time. This is certainly bad news, but based on lack of updates from AVID the last couple of weeks, it was somewhat expected. The glass is not empty; in fact, based on the information in the Company's press release, it appears that while things are not good, they may be better than many had expected.

- AVID submitted its plan to NASDAQ regarding how it will try to regain compliance. While such plan requires approval from NASDAQ, if approved, the Company will have until mid-September to file the CY '12 10-K. If it can do that, we think the quarterly filings will follow shortly after.

- AVID provided an update, although a vague one, on what it has discovered during its evaluation of the accounting treatment of maintenance revenues, or as the Company stated, the "Software Updates". It found that it needs to restate not only Q1 - Q3 for CY '11 and CY '12, but also the 10-Ks for CY '09 - CY '11. However, according to the Company, while it appears that the main issue is the timing of revenue recognition, "the restatement adjustments are not expected to affect the amount of total revenue ultimately to be earned, or the amount or timing of cash received or to be received, from the sales transactions or the Company's liquidity or cash flow for any prior period."

- The Company also said that it may have overstated its restructuring expenses by around $3.5MM for Q3 '12.

We are not saying that this is a safe bet now. In fact, as this 'discovery process' is ongoing, AVID could find additional issues. However, if (a big if), AVID successfully regains compliance by mid-Sept., one could again primarily look at the Company's valuation and take out the compliance and accounting risks that have dragged this stock down. And appears that it will drag it down further for the time being as AVID took a 12% dump in AH on Tuesday.

Monday, May 20, 2013

Thursday, May 16, 2013

Move along, nothing to see here!

With disappointing initial jobless claims and Philadelphia manufacturing survey results, the market is pretty much saying 'no problem', as the S&P 500 is now green. It appears that Hilsenrath's article about the Fed's 'maybe, maybe not' QE exit strategy has done its job - the market reacts positively to good economic news, and it reacts positively to bad economic news. Interesting that while there was so much debate going on around whether or not insurance companies must be forced not to automatically reject people with pre-existing health conditions, everyone keeps pushing and begging the Fed to keep 'insuring' the equity market. As we have said before, we are going along for the ride, but at these levels, for safety reasons, we're holding on to something as it might get bumpy.

Regarding AVID, the stock spiked up 2% at around 11:15AM (ET), on pretty good volume. The deadline for the Company to submit a plan to NASDAQ on how it will regain compliance is Monday, 5/20. With the resignation of former CEO, Gary Greenfield, from his latest so-called consulting position, some are thinking that AVID will provide an update sooner than later. And it appears that some (or someone) bet about 30 minutes ago that the update will be good news. The stock is up only 1.5% now for the day.

Regarding AVID, the stock spiked up 2% at around 11:15AM (ET), on pretty good volume. The deadline for the Company to submit a plan to NASDAQ on how it will regain compliance is Monday, 5/20. With the resignation of former CEO, Gary Greenfield, from his latest so-called consulting position, some are thinking that AVID will provide an update sooner than later. And it appears that some (or someone) bet about 30 minutes ago that the update will be good news. The stock is up only 1.5% now for the day.

Wednesday, May 15, 2013

IACI: More good news ...

Unlike most news coming from Congress these days, we are happy to say that the latest regarding IACI's Aereo is good news. According to an article published by The Hill, Sen. Mark Warner (D-Va.) said to TV broadcasters yesterday that "threatening to withdraw content because of these other challenges, that really raises for me the question of whether you ought to be able to keep that spectrum for free, which is a public good and maybe could be utilized for better public purposes."

http://thehill.com/blogs/hillicon-valley/technology/299679-sen-warner-fires-warning-shot-at-broadcasters-over-aereo

Aereo continues to expand in different markets around the country, with Atlanta being the latest one. Aereo has come out ahead in courts and it appears that even the lawmakers are on its side.

Aereo continues to expand in different markets around the country, with Atlanta being the latest one. Aereo has come out ahead in courts and it appears that even the lawmakers are on its side.

You can be the judge ...

Could this be the start of one last push by professionals to get more retail investors in the game and drive the market higher one last time before the Fed begins to wind down QE? You can be the judge ... Fed QE Tapering Now Needed To Avoid Bubbly 'Hyper Drive

On another note, IACI continues to perform well. It is up 3% at $51.74/sh on ok volume. It appears that a few funds increased their holdings in IACI during Q1. Even though we upped our valuation of the Company just recently on 5/1 (to $54/sh from $52/sh), the stock is now around 4% from reaching it. BCOR is up more than 1%, at $17.85. As a reminder, we increased our valuation to $21.25/sh (from $19.00/sh) last week. We did see some profit taking earlier this week. While the overall equity market keeps disappointing the pessimists, although again we believe it is overvalued, some immunization to FB due to its disappointing performance appears to be at work. The stock is down nearly 1%, even though the market turned positive approx. 30 minutes ago. And AVID is pretty much flat right now.

Tuesday, May 14, 2013

Equity Market Flying High!

S&P 500 is up nearly 1% even though there's been talk of the Fed slowly exiting QE. Could this be the last 'umpf' for the market before a small correction? As we noted last week, the equity market is overvalued, in our opinion. Pretty soon we could see that QE premium, currently priced in, get discounted. In fact, today's uplift includes not only the cyclical sectors, but also the utilities sector, up nearly 1%, along with other defensive a such as healthcare and consumer staples. By the way, VIX is up 5%+; still below $15, but looks like the VIX and equity market divergence is beginning to converge, at least early on today.

IACI: Aereo Expanding faster than many expected

Aereo announced that it'll be in the Atlanta market in June (https://aereo.com/pr/atl).

IACI is up 2%+ approaching $50/sh on heavy volume.

Saturday, May 11, 2013

Fed Maps Exit From Stimulus (WSJ)

Well, soon after we posted our thoughts about the overall equity market (S&P 500), Mr. Hilsenrath, 'the market savior' journalist of The Wall Street Journal, published an article discussing the Fed's QE potential exit strategy. Hilsenrath has been a savior for the equity market the last couple of years, as pretty much every time there was bad economic news, he would get 'hints' from the Fed that further QE would be pushed to up the stock market, hopefully increasing everyone's wealth via the good 'ol 'trickle down' economics. Well, this time, his article is about the exit strategy, and surprisingly, he published it on a Saturday! Remember that we did touch on the Fed approaching an exit strategy and how that might take out the 'QE premium' that is currently priced in the equity market. Enjoy the article (link included).

"Federal Reserve officials have mapped out a strategy for winding down an unprecedented $85 billion-a-month bond-buying program meant to spur the economy—an effort to preserve flexibility and manage highly unpredictable market expectations. ... " - Fed Maps Exit From Stimulus (WSJ)

"Federal Reserve officials have mapped out a strategy for winding down an unprecedented $85 billion-a-month bond-buying program meant to spur the economy—an effort to preserve flexibility and manage highly unpredictable market expectations. ... " - Fed Maps Exit From Stimulus (WSJ)

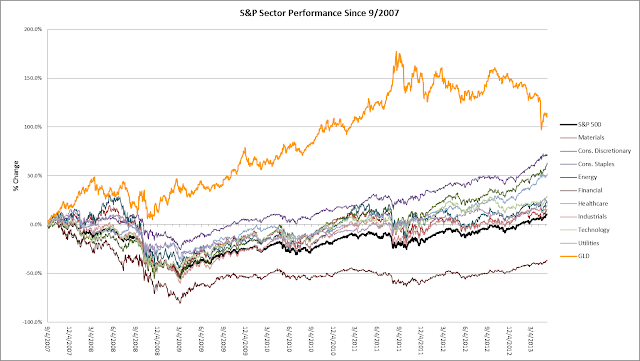

Is S&P 500 Overvalued?

As more than 90% of the S&P 500 companies have reported Q1 results, combined with continuation of modest economic recovery, and state of employment being in a slightly better shape than we have been projecting, we thought to take a look at the S&P 500 to see whether it is undervalued or not. In our opinion, it is overvalued.

Let's start with 2013 projections. According to S&P, 2013 S&P 500 EPS (operating income estimates from bottom up) are expected to grow 13% Y/Y. This growth is partially driven by the overall economic recovery; however most of it is from margin expansion, which is due to company cost-cutting measures and not necessarily top-line growth. But let's say, demand increases and companies will be generating higher revenues. Unfortunately, given the significant cost cutting measures implemented the last 5 years, increase in demand will demand higher costs such as increased headcount. What will keep cost increases somewhat in check will be continuing stagnation in wage growth. We note that although commodities have taken a hit recently, any further confirmation of continuing economic growth will push them up again, increasing costs for companies. In addition, many geopolitical factors are still in play. While capex and other investments may increase, which is good news, again, we think it will be limited. It will be tough for public companies to show shareholders that the bottom-line can continue to grow. Of course, many could change their accounting methods and make those non-GAAP EPS look good, but that's another topic for another time.

So we could basically see modest increase in demand, higher headcount, lower margins, and not much of an increase in consumers' disposable income. Simply put, at least in the short to medium term, higher demand might be costly for many companies. All of this will make the continuation of strong EPS growth less likely.

Based on where the S&P closed at on 5/10, it has a forward P/E of 14.9, based on 2013 EPS projections. We think this indicates that the index is overvalued. Based on the 5-year CAGR consensus of 10.7% and a 2.1% annual dividend yield, we think S&P 500 should be valued at approx. 13x 2013 EPS, or at around 1429. This represents a PEG of 1.0. At 1633.70, the index is 14% above what could be its fair value based on 2013 numbers. Obviously, there is a QE premium built into this.

Now, given that we are almost half-way through 2013, let's look at 2014. Based on the $123.13 EPS estimate, it appears that only 12% Y/Y EPS growth is expected in 2014, lower than this year's 13%. This goes along with what we mentioned earlier regarding lack of further significant margin expansion going forward. Given declining bottom-line growth, we think the P/E (along with the dividend yield) should represent a PEG of slightly below 1.0. We applied a mere 5% discount to our 2013 13 EPS multiple, which resulted in a 12.35 P/E. Applying this to 2014 EPS estimate, gave us a valuation of approx. 1521 for the S&P 500, representing a 7% downside from where the index closed on Friday.

We still have half of 2013 ahead of us, so we took the midpoint of our estimates, 1475, as our projected fair value of the S&P 500 for the next 12 - 18 months, representing a 10% downside.

There are certainly other factors that can push the S&P 500 much higher or lower. They include continuation (or not) of the Fed's QE policy, improvement (or not) of the state of the economy in the EZ, potential stability (or not) in the Middle East, and many other factors. However, we think the Fed should be thanked for such a huge premium that we are seeing when it comes to the value of the equity market. Unfortunately, its time will come, and we and the market will have to adjust. As the economy keeps improving and as Bernanke will be trying his best to avoid the creation of another bubble, we think we are getting closer to that time. From a fundamental standpoint, the S&P 500 should be valued at around 1475 during the next 12 - 18 months, in our opinion.

There are certainly other factors that can push the S&P 500 much higher or lower. They include continuation (or not) of the Fed's QE policy, improvement (or not) of the state of the economy in the EZ, potential stability (or not) in the Middle East, and many other factors. However, we think the Fed should be thanked for such a huge premium that we are seeing when it comes to the value of the equity market. Unfortunately, its time will come, and we and the market will have to adjust. As the economy keeps improving and as Bernanke will be trying his best to avoid the creation of another bubble, we think we are getting closer to that time. From a fundamental standpoint, the S&P 500 should be valued at around 1475 during the next 12 - 18 months, in our opinion.

Friday, May 10, 2013

BCOR: Upping Our Valuation to $21.25/sh (from $19.00/sh)

Given that Blucora (BCOR) has increased 24%+ since we mentioned it in late Jan. (nearly 3x that of the S&P 500), is now within only 1% of our valuation, and that we are nearly half-way through 2013, we are introducing our 2014 estimates, along with the new price target of $21.25/sh. Our new valuation represents a sum-of-parts: 6x search adj. EBITDA, 8x tax services EBITDA, and $148.7MM in net cash.

We have not adjusted our 2013 estimates: search revenues of $387.9MM; search adj. EBITDA of $58.2MM; tax services revenues and adj. EBITDA of $97.6MM and $48.8MM, respectively.

For 2014, we expect continuing double-digit top-line growth within the search segment; 15.1%, compared with our conservative 2013 projection of 12.5%. Although overall online search revenue growth is expected to slow down a bit in 2014, we expect BCOR's adjustments to Google's (GOOG) latest pricing policies to be completed by Q3 of 2013, from which the benefits will be seen in 2014 revenue growth. While such transition will be successful, we see BCOR also focusing on pushing the O&O share of search revenues a bit higher. With all this said, we expect EBITDA margin to remain flat at 15% compared with our 2013 projection, which, again, we believe to be conservative. We look for 2014 search revenues and adj. EBITDA of $446.5MM and $67.0MM, respectively.

Regarding BCOR's tax services segment, we expect nearly an 8% revenue growth in 2014, driven mainly by a higher NFP estimate for 2013, which means likely more tax payers in 2014 tax season. We estimate an average of 200K change in NFP per month in 2013. In addition, we think 2014 TaxAct's total units, as a percentage of 2013 NFP will go up a few bps to approx. 4%. This translates into approx. 5.5MM total units during 2014 tax season, generating around $94.6MM in revenues. For Q3 and Q4 '14, we expect additional $3.0MM in revenues, bringing 2014 total tax services revenues to $97.6MM. In addition, we think BCOR's marketing, development, and partnership strategies will pay off more next year, possibly increasing this segment's EBITDA margin to 50%, which equates to $48.8MM in EBITDA, 11% growth from the prior year.

Again, our sum-of-parts valuation based on 2014 numbers, results in $21.25/sh; 13% upside from where BCOR closed at on Friday (5/10). Lastly, BCOR management will be presenting at JMP Securities Research conference in San Francisco on Monday (5/13).

We have not adjusted our 2013 estimates: search revenues of $387.9MM; search adj. EBITDA of $58.2MM; tax services revenues and adj. EBITDA of $97.6MM and $48.8MM, respectively.

For 2014, we expect continuing double-digit top-line growth within the search segment; 15.1%, compared with our conservative 2013 projection of 12.5%. Although overall online search revenue growth is expected to slow down a bit in 2014, we expect BCOR's adjustments to Google's (GOOG) latest pricing policies to be completed by Q3 of 2013, from which the benefits will be seen in 2014 revenue growth. While such transition will be successful, we see BCOR also focusing on pushing the O&O share of search revenues a bit higher. With all this said, we expect EBITDA margin to remain flat at 15% compared with our 2013 projection, which, again, we believe to be conservative. We look for 2014 search revenues and adj. EBITDA of $446.5MM and $67.0MM, respectively.

Regarding BCOR's tax services segment, we expect nearly an 8% revenue growth in 2014, driven mainly by a higher NFP estimate for 2013, which means likely more tax payers in 2014 tax season. We estimate an average of 200K change in NFP per month in 2013. In addition, we think 2014 TaxAct's total units, as a percentage of 2013 NFP will go up a few bps to approx. 4%. This translates into approx. 5.5MM total units during 2014 tax season, generating around $94.6MM in revenues. For Q3 and Q4 '14, we expect additional $3.0MM in revenues, bringing 2014 total tax services revenues to $97.6MM. In addition, we think BCOR's marketing, development, and partnership strategies will pay off more next year, possibly increasing this segment's EBITDA margin to 50%, which equates to $48.8MM in EBITDA, 11% growth from the prior year.

Again, our sum-of-parts valuation based on 2014 numbers, results in $21.25/sh; 13% upside from where BCOR closed at on Friday (5/10). Lastly, BCOR management will be presenting at JMP Securities Research conference in San Francisco on Monday (5/13).

Monday, May 6, 2013

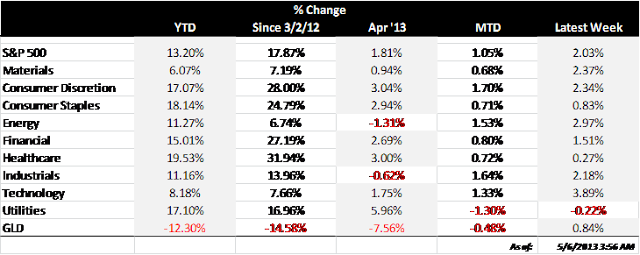

Performance Update for Week of 4/29 - 5/3

We did not have a chance to post our weekly updates (or any other post) for a couple of weeks. We are certainly trying our best to remain consistent.

- AVID has actually hung in there better than we thought. The Company has not yet updated the Street regarding its review of how it recognizes some services revenues. It also has not provided any color about if or when it will release FY '12 and Q1 '13 results. If this issue is resolved, and we currently have no idea whether it will be or not, then based on our $9/sh valuation, there is a 31% upside. However, such upside is associated with a lot of risk.

- Some good Q1 results and positive guidance brought some attention back to BCOR. It is only 7% away from reaching our valuation of $19/sh. For this reason, our 'undervalued' label is pretty close to becoming an exaggeration. We could see some profit taking this week, especially given the big jump in the name late last week.

- FB went up a bit after its Q1 results, and we continue to view it as overvalued. Others have similar opinions on FB as we posted a bit earlier today.

- IACI has been moving up steadily. Its near 2% dividend yield is a plus. It came within 8% of our initial $52/sh valuation. However, we upped it to $54/sh, and with that, there is still a 12% upside, even after the near 20% gain since late Jan. We note that similar to BCOR, our 'undervalued' label on this name is pretty close to becoming an exaggeration.

FB: Facebook's Results Fail to Impress (Barron's)

This is part of what Barron's said about Facebook (FB) on Sat., 5/4; similar to what we have been saying for a long time and our latest post on 5/2, after the Company's earnings release. Link to the story is also provided below.

"Facebook racked up big gains in mobile advertising, but at the expense of its core desktop business. With a market value of $71 billion and annualized mobile revenue of just $1.5 billion, that's hardly something to celebrate ... " - Facebook's Results Fail to Impress (Barron's)

Friday, May 3, 2013

BCOR Up 19%+; NFP Beat Expectations; "Bull on bull ..." ...

It appears the 'macro worry' that we had yesterday, thinking it may limit BCOR's increase after good Q1 numbers, was actually a non-worry. BLS reported NFP change for April higher than our estimate and the Street's. We note that after the disappointing ADP report on Wednesday, many economists lowered their NFP guesstimates, which brought the consensus down to 145K. BCOR was upgraded to a 'buy' by Craig Hallum research, and the stock is up more than 19% on heavy volume. IACI is up 2.6%; AVID just hit the $7 mark for the first time since late Feb., and FB is down 0.3% or 9c.

Non-farm paryolls increased by 165K in April, higher than our 150K and the Street's 145K estimates. The data (which we hope is not 'fiddled' with) provided by BLS shows slight weakness in goods-producing jobs, more specifically in construction. Strength was apparent on the private-service side, with leisure & hospitality, temp, retail, and healthcare leading the way.

In terms of hours and earnings, although average pay increased by 4c, average weekly hours worked declined to 34.4 from 34.6 in March.

In addition, while the headline unemployment rate declined by 10bps to 7.5%, what we consider as the real unemployment rate (U-6 in the BLS report) increased for the first time this year, up 10bps to 13.9%.

BLS also revised the last two months' NFPs much higher, which is good news. However, lately, including the monthly revisions, something a bit unusual has happened - monthly net changes in ADP and BLS (NFP) reports have been diverging a bit. Who knows what data by which org is being 'fiddled' with or if everything is legitimate, but that's something to keep an eye on.

Lastly, the way the equity market is moving, as someone tweeted earlier this morning, "You are witnessing bull porn here ... Bull on bull action"!

Non-farm paryolls increased by 165K in April, higher than our 150K and the Street's 145K estimates. The data (which we hope is not 'fiddled' with) provided by BLS shows slight weakness in goods-producing jobs, more specifically in construction. Strength was apparent on the private-service side, with leisure & hospitality, temp, retail, and healthcare leading the way.

In terms of hours and earnings, although average pay increased by 4c, average weekly hours worked declined to 34.4 from 34.6 in March.

In addition, while the headline unemployment rate declined by 10bps to 7.5%, what we consider as the real unemployment rate (U-6 in the BLS report) increased for the first time this year, up 10bps to 13.9%.

BLS also revised the last two months' NFPs much higher, which is good news. However, lately, including the monthly revisions, something a bit unusual has happened - monthly net changes in ADP and BLS (NFP) reports have been diverging a bit. Who knows what data by which org is being 'fiddled' with or if everything is legitimate, but that's something to keep an eye on.

Lastly, the way the equity market is moving, as someone tweeted earlier this morning, "You are witnessing bull porn here ... Bull on bull action"!

BCOR: Strong Q1 Results and Q2 & FY '13 Guidance

Blucora (BCOR) reported Q1 results well ahead of expectations. Total revenues and GAAP EPS came in at $165.3MM and $0.53, respectively, compared with the Street's $158.8MM and $0.50. Management provided good guidance for Q2. The stock was up 13%+ AH. We continue to value it at $19/sh, representing a 29% upside from where it closed at on Thursday.

Search segment performed much better than we expected, with a 34% Y/Y growth in revenues. Both divisions of the search segment, distribution and owned & operated (O&O), performed well with 35% and 27% Y/Y revenue growth, respectively. On the margin front, Q1 came in at 18%, flat compared to the prior year. This is actually good news given the short-term negative impact of GOOG's new pricing policies that we had expected.

Tax preparation revenues for the quarter were $64.7MM, up approx. 5% Y/Y. Tax segment operating margin of 48% displays the reason why BCOR acquired TaxAct last year. Although impressive, this figure was below last year's 49%, but mainly due to BCOR's efforts to add more options to their tax preparation services via development and partnerships. In addition, the Company was marketing its offering more aggressively during this year's tax season. We note that this tax season's total do-it-yourself tax filings (or e-files) through TaxAct were 8% higher than last year, growth well above the 4% that IRS’ self-prepared e-file experienced. In addition, TaxAct’s professional preparer filings were up 10% Y/Y.

Management also said it may begin looking at more possible acquisitions. Given the success of the TaxAct acquisition that we are seeing, we are confident it will make decisions beneficial for the Company and shareholders. We believe management will initially look at some of its smaller partners in search, given that some of them are having difficulties adjusting to GOOG's new policies.

For Q2, management guided revenues of $90.0MM - $94.0MM for the search segment, with operating margin between 17% and 18%. The Company expects tax preparation revenues between $23.0MM and $23.5MM, with an impressive 63% - 64% margin. We note that since the tax season was over on April 16, management is not planning to aggressively market TaxAct services for the remainder of Q2. This explains the expectation of much higher margins. Again, overall Q2 guidance was pretty positive. The Company expects Q2 revenues between $113.0MM and $117.5MM, significantly above the $108.0MM consensus. GAAP net income guidance was between $9.0MM and $10.0MM, in-line with expectations. The GAAP EPS guidance was below consensus, but that is mainly because of a higher diluted sharecount due to convertible senior notes offered in Q1.

We have not made any significant changes to our FY '13 estimates. For search, we still expect $387.9MM and $58.2MM in revenues and EBITDA, respectively. We estimate $90.5MM revenues from tax preparation, which could generate around $44.0MM in EBITDA.

Our sum-of-parts valuation, consisting of 6x search EBITDA, 8x tax preparation EBITDA, plus net cash of $148.7MM, results in a market cap of approx. $850MM, higher than our last estimate which was $790MM. However, due to a higher sharecount, our per-share valuation of BCOR remains $19. The stock was up 13.6% in AH trading. While we hope such spike will continue during regular trading hours on Friday, some possibly disappointing macro news (such the April NFP count) may prevent that from happening.

Thursday, May 2, 2013

IACI & BCOR Updates ...

IAC/InterActive (IACI)

We just wanted to share some news regarding IACI. First, UBS reiterated its 'buy' rating and upped its price target on IACI to $58/sh from $55/sh. As a reminder, we increased our valuation of the Company to $54/sh from $52/sh.

In addition, some comments made about Aereo (a small technology company, owned by IACI, that distributes TV network content over the Internet for very low prices) by Time Warner Cable's (TWC) CEO got our attention, and we view it as positive for Aereo and IACI. The story was posted on The Washington Post this afternoon. One of his comments is provided below, along with a link to the full story.

-- “What Aereo is doing to bring broadcast signals to its customers is interesting,” Time Warner Cable chief executive Glenn Britt said in an interview with The Washington Post. “If it is found legal, we could conceivably use similar technology.” -- Time Warner CEO says company may consider Aereo-like streaming service.

After moving up more than 4% earlier this week (and being up more than 17% since late Jan.), IACI gave some of it back today, closing down by approx. 1%.

Blucora (BCOR)

Lastly, regarding BCOR Q1 earnings, the Company beat the Street estimates and provided pretty good Q2 guidance. We will provide more detail later today. BCOR is up more than 12% in AH trading.

We just wanted to share some news regarding IACI. First, UBS reiterated its 'buy' rating and upped its price target on IACI to $58/sh from $55/sh. As a reminder, we increased our valuation of the Company to $54/sh from $52/sh.

In addition, some comments made about Aereo (a small technology company, owned by IACI, that distributes TV network content over the Internet for very low prices) by Time Warner Cable's (TWC) CEO got our attention, and we view it as positive for Aereo and IACI. The story was posted on The Washington Post this afternoon. One of his comments is provided below, along with a link to the full story.

-- “What Aereo is doing to bring broadcast signals to its customers is interesting,” Time Warner Cable chief executive Glenn Britt said in an interview with The Washington Post. “If it is found legal, we could conceivably use similar technology.” -- Time Warner CEO says company may consider Aereo-like streaming service.

After moving up more than 4% earlier this week (and being up more than 17% since late Jan.), IACI gave some of it back today, closing down by approx. 1%.

Blucora (BCOR)

Lastly, regarding BCOR Q1 earnings, the Company beat the Street estimates and provided pretty good Q2 guidance. We will provide more detail later today. BCOR is up more than 12% in AH trading.

FB: Slightly Mixed Q1 Numbers; Remains Over-valued

Facebook (FB) Q1 numbers, reported Wednesday after the close, were a bit mixed. Revenues of $1.46bil were slightly higher than the $1.44bil consensus, while $0.12 non-GAAP EPS were slightly below the Street's $0.13. The miss on the bottom-line was due to the Company's increased costs and expenses, which went up 60% compared to a year ago, while revenues grew 38%. Operating margin of 26% was significantly less than 36% in Q1 '12. The Company continues to increase headcount and spend money on infrastructure, according to management.

As we said before, although revenues came in better than expected, the same issues linger - slowdown in user growth within the most profitable region (North America), while better user growth is in regions with much lower ARPUs (although growing); and monetization of users moving onto mobile devices. In our opinion, FB is taking the right steps to address these issues, but it will take time to see if those moves will be considered as successful. From a fundamental standpoint, the stock remains overvalued. FB was up $0.08, or 0.30%, in AH trading.

Growth in North American MAU continued to slowdown. Y/Y MAU growth in that region was only 6.6%, while growth in Europe, Asia, and other regions were 12.6%, 36.3%, and 33.5%, respectively. This is compared to Y/Y growth rates of 7.8%, 14.0%, 40.6%, and 35.1% in Q4.

Again, highest ad ARPUs came from the slowest growing region, North America; although it grew 23.6% Y/Y. We must note that ad ARPU in the 'other' regions did grow north of 42% Y/Y, but it was only $0.46. In fact, revenues from that region accounted for only 12% of FB's total revenues, while revenues from North America were 44%. So, geographically speaking, we have the North American region users growing at the slowest rate, but generating highest ARPU. From a positive standpoint, we could say that this demonstrates success in monetizing the user base over time; and we could see similar success in other regions. However, we must note that not everywhere is as consumer driven as the US.

Mobile monetization is moving along as based on total mobile MAU of 751MM, we estimate mobile ARPU was $0.58 in Q1. However, this figure is below last quarter's $0.63. While some may argue that part of this is due to seasonality, we must note that seasonality is slightly discounted when it comes to such a hot platform that remains in its early growth stages. So, that nickel decline in mobile ARPU is a bit concerning. We will have to wait until 2013 Q4 results to get a better idea of whether or not mobile will continue to grow significantly and/or it will cannibalize desktop based revenues, which remain strong but many users continue to switch to the mobile platform.

While we continue to believe the Company is moving in the right direction, the FB stock remains over-valued in our opinion. We did not make significant changes to our model. FB is trading at more than 35x 2013 EPS with a PEG of 1.6; and at nearly 48x trailing EBITDA. From a valuation standpoint, this is a bit alarming given that we are seeing more costs & expenses and lower margins. We upped our FCF estimates slightly, driven by higher than expected revenues and partially offset by lower margins. Our 5-year DCF model, which we think is appropriate for this company as it remains in a growth (hopefully!) and investment mode, spits out a $23.50/sh valuation, $0.50/sh higher than our previous estimate. The stock closed at $27.43 on Wednesday. We note that since we suggested shorting FB in May '12, potential return has been approx. 20%, pretty much in-line with how much the S&P 500 index has increased since then.

As we said before, although revenues came in better than expected, the same issues linger - slowdown in user growth within the most profitable region (North America), while better user growth is in regions with much lower ARPUs (although growing); and monetization of users moving onto mobile devices. In our opinion, FB is taking the right steps to address these issues, but it will take time to see if those moves will be considered as successful. From a fundamental standpoint, the stock remains overvalued. FB was up $0.08, or 0.30%, in AH trading.

Growth in North American MAU continued to slowdown. Y/Y MAU growth in that region was only 6.6%, while growth in Europe, Asia, and other regions were 12.6%, 36.3%, and 33.5%, respectively. This is compared to Y/Y growth rates of 7.8%, 14.0%, 40.6%, and 35.1% in Q4.

Again, highest ad ARPUs came from the slowest growing region, North America; although it grew 23.6% Y/Y. We must note that ad ARPU in the 'other' regions did grow north of 42% Y/Y, but it was only $0.46. In fact, revenues from that region accounted for only 12% of FB's total revenues, while revenues from North America were 44%. So, geographically speaking, we have the North American region users growing at the slowest rate, but generating highest ARPU. From a positive standpoint, we could say that this demonstrates success in monetizing the user base over time; and we could see similar success in other regions. However, we must note that not everywhere is as consumer driven as the US.

Mobile monetization is moving along as based on total mobile MAU of 751MM, we estimate mobile ARPU was $0.58 in Q1. However, this figure is below last quarter's $0.63. While some may argue that part of this is due to seasonality, we must note that seasonality is slightly discounted when it comes to such a hot platform that remains in its early growth stages. So, that nickel decline in mobile ARPU is a bit concerning. We will have to wait until 2013 Q4 results to get a better idea of whether or not mobile will continue to grow significantly and/or it will cannibalize desktop based revenues, which remain strong but many users continue to switch to the mobile platform.

While we continue to believe the Company is moving in the right direction, the FB stock remains over-valued in our opinion. We did not make significant changes to our model. FB is trading at more than 35x 2013 EPS with a PEG of 1.6; and at nearly 48x trailing EBITDA. From a valuation standpoint, this is a bit alarming given that we are seeing more costs & expenses and lower margins. We upped our FCF estimates slightly, driven by higher than expected revenues and partially offset by lower margins. Our 5-year DCF model, which we think is appropriate for this company as it remains in a growth (hopefully!) and investment mode, spits out a $23.50/sh valuation, $0.50/sh higher than our previous estimate. The stock closed at $27.43 on Wednesday. We note that since we suggested shorting FB in May '12, potential return has been approx. 20%, pretty much in-line with how much the S&P 500 index has increased since then.

Wednesday, May 1, 2013

IACI: Mixed Q1 Results; the Future Continues to Look Bright

As we mentioned yesterday, IACI reported Q1 earnings on Tuesday and beat on the bottom-line but missed revenue estimates. Total revenues of $742.3MM were below the $757.3MM consensus. Non-GAAP EPS of $0.83 were significantly higher than the Street's $0.69. Even with the revenue miss, IACI reported impressive margin expansion and we believe this will continue going forward. However, we did slightly lower our 2013 adj. EBITDA estimate due to the revenue miss. We would rather remain conservative, although we do believe management and the Company will get back on track in Q2 and going forward. More detail regarding revenues is provided below. We upped our valuation to $54.00/sh (from $52.00/sh) due to a lower share count at the end of Q1. IACI repurchased 1.4MM shares in Q1 at an average price of $42.96. So we do see that price level as a floor, especially given that the IACI Board authorized the Company to purchase another 10MM. The Company currently has 11.7MM shares in its stock repurchase plan.

IACI closed up 1.1% on Wednesday at $47.57. It has increased 17.7% since we first suggested it in late Jan. '13, compared to S&P 500's 5.0% increase. As a reminder, IACI's $0.24/sh quarterly dividend is yielding around 2%.

IACI closed up 1.1% on Wednesday at $47.57. It has increased 17.7% since we first suggested it in late Jan. '13, compared to S&P 500's 5.0% increase. As a reminder, IACI's $0.24/sh quarterly dividend is yielding around 2%.

- Revenue miss was due to slightly lighter than expected search & applications revenues, along with Y/Y decline in Local revenues.

- While search & apps revenues were up 16% Y/Y, we note that excluding $31.3MM from The About Group (which was acquired last Sept.), growth was 7%, slightly below our 8% assumption, but significantly lower than the Street's estimate.

- In addition, the change in Google's policies, to which management stated IACI has adjusted going into Q2 and beyond, drove down average revenue per query (excl. About queries and revenues) compared to Q1 '12. Growth in queries remained impressive at 17% Y/Y.

- Excluding About, we did see margin expansion, which is very good news given GOOG's latest policies. Operating margin in that segment increased 50bps Y/Y to 21.9%. The About Group's operating margin is 40%+. We could see a slight margin decline search & apps in Q2 as the Company plans to increase marketing.

- Match segment revenues came in better than other analysts' expectations, but below ours. We thought that revenues from the non-Internet events would have a better impact on that segment's total revenues. In addition, we expected a 10% Y/Y increase in Match's Core division; however the Company reported an 8% growth.

- Total subscribers in Core, Meetic, and Developing divisions were up 11% Y/Y. Developing led the way with a 45% growth. We note that the subscriber count in Developing is only about a fifth of Core's.

- Average revenue per sub in the quarter declined to $60.16 from $61.79. We believe this was due to stronger growth in Developing which does generate slightly less revenues per subscriber.

- Match segment operating margin increased to 21.7% from 17.2%.

- According to management, Local revenue decline was due to domain name change of HomeAdvisor. This was evident as domestic service requests and acceptances declined 25% and 20% Y/Y, respectively.

- Media revenues increased 185% Y/Y, mainly due to acquisitions made in May of last year. However, it did experience operating loss of $8.8MM, slightly more than last year's $6.7MM. Discontinuation of Newsweek will likely help this segment's margins going forward.

Overall, management sounded a bit more optimistic than the last earnings call. For 2013, it expects double-digit top-line growth and OIBA growth of around 30%. We remain conservative with our projected 2013 OIBA representing 26% growth, and can be translated into 24% growth in adj. EBITDA and a 20% adj. EBITDA margin. Our $54.00/sh valuation remains based on 7.5x 2013 adj. EBITDA and net cash of approx. $100MM.

ISM Mfr. & ADP Disappoint; IACI Up in Early Trading ...

The 50.7 manufacturing ISM index for April was below ours and the Street's expectations. That figure was also lower than March's 51.3.

- New orders and production sub-indexes both increased, but we think it might be driven by what has been a pretty tight inventory control over the last couple of months. We note that the data indicates such inventory management not only on the suppliers' side but also by customers'.

- Employment sub-index dipped 4.0 to 50.2, which is not necessarily good news.

- Exports sub-index declined after a strong showing in March, while imports increased after being pretty much flat in March.

- The 4.5-point decline in prices (to 50.0) may be good news for the bottom-line of producers in the US as it may indicate lower costs. However, it could also be the 'substitute driver' behind uptick in new orders and production. We would rather see those sub-indexes increase by stronger demand.

On the jobs front, ADP reported a very disappointing 119K jobs added in April. This was significantly below the 155K estimate, and may indicate a disappointing NFP number due out on Friday. As mentioned in our previous post, we did project NFP lower than the Street's. Assuming there are no significant revisions, this morning's ADP indicates NFP might be even lower. Speaking of revisions, ADP did so by lowering its March number to 131K, from 158K! So, this latest 119K net addition of jobs is even worse than it looks. Based on this, monthly net change in NFP may come in around 130K - 140K, lower than the 153K consensus.

The update on IACI is a bit more positive. It shed its AH losses and is currently up more than 1.3% at $47.70. Again, we will provide more detail on the Company's mixed Q1 results later today.

It looks like the market has begun to hope for some soothing words and thoughts, especially after disappointing economic data, from the FOMC meeting later this afternoon. After dipping more than 0.60%, the S&P 500 has pared its losses, being down only around 0.34%.

ISM Mfr. & April NFP projections; IACI Earnings ...

The ISM manufacturing index will be released on Wednesday (5/1) at 10am (ET). We project an ISM of 51.1, pretty much in-line with the 51.0 consensus. We note that last month's manufacturing ISM figure was 51.3. Based on lack of month/month improvement seen in regional manufacturing surveys conducted by various regional Reserve Banks, we do not expect ISM to come in better than the previous month. We note that a miss could be offset by what is expected to be continuing dovish comments from the FOMC, which began on Tuesday and will continue through Wednesday. Official statement from the FOMC meeting will be released at 2pm (ET) on Wednesday.

Regarding Friday's upcoming NFP figure, we estimate that number to be slightly below the 153K consensus. We are projecting a +150K change in NFP for the month of April. We note that if Wednesday's ADP number turns out to be significantly higher or lower than the 155K consensus, it could impact not only our estimate but also the Street's.

Lastly, IACI reported mixed Q1 results on Tuesday after the close. While it blew away estimates on EBITDA and net income, it missed on the top-line. Its search & apps segment performed much better than expected, but that was more than offset by disappointing revenues in the Match segment. We will provide more detail after we review the results and listen to the earnings call. The stock did gain nearly 3% on Tuesday; however it appears it will give it all back on Wednesday as it was down 3.5% in AH. As a reminder, FB will be reporting Wednesday after the close, while BCOR is scheduled for Thursday after the close.

Regarding Friday's upcoming NFP figure, we estimate that number to be slightly below the 153K consensus. We are projecting a +150K change in NFP for the month of April. We note that if Wednesday's ADP number turns out to be significantly higher or lower than the 155K consensus, it could impact not only our estimate but also the Street's.

Lastly, IACI reported mixed Q1 results on Tuesday after the close. While it blew away estimates on EBITDA and net income, it missed on the top-line. Its search & apps segment performed much better than expected, but that was more than offset by disappointing revenues in the Match segment. We will provide more detail after we review the results and listen to the earnings call. The stock did gain nearly 3% on Tuesday; however it appears it will give it all back on Wednesday as it was down 3.5% in AH. As a reminder, FB will be reporting Wednesday after the close, while BCOR is scheduled for Thursday after the close.

Subscribe to:

Posts (Atom)