On a day that appears will be an ok one for the equity market overall, AVID is taking a big dump. While the S&P 500 futures is up 0.5%, AVID shares are sliding, down almost 15%. It could get worse as the Company announced it has to postpone its Q4 earnings announcement (originally scheduled to be released tomorrow after the close) to evaluate its current and historical accounting treatment related to bug fixes, upgrades and enhancements to certain products that it sold to some clients. It came across this during its normal review of Q4 and FY '12 financial results. Unfortunately, the Company does not yet know when it will finish such review and release its Q4 results.

Monday, February 25, 2013

Tuesday, February 19, 2013

Thursday, February 14, 2013

Jan. Industrial Production and Capacity Utilization Expectations

Industrial production and capacity utilization for January will be released tomorrow morning at 10am (ET). Given the surprising upside that we saw in Jan. ISM-manufacturing index, we think industrial production may come in slightly ahead of expectations. Our estimate is 98.5%, a 0.4% increase from Dec. The consensus stands at 98.4%. With not much overall change in the work week figures of most regional surveys, we think capacity utilization will likely be in-line with the Street's estimate of 78.9%, a 0.1% sequential increase.

Investors Must Lower Their Expectations for Returns: Arnott

We found the article/video, Investors Must Lower Their Expectations for Returns: Arnott, on Yahoo! Finance. Mr. Arnott is basically saying what we have been trying to say the last few years. Unfortunately, the QE policies do not allow individuals and investors to save. Those policies basically force them to take much more risk, especially given the stagnation of wage growth, with not nearly as much potential additional return. The video and article can be accessed here: http://finance.yahoo.com/blogs/breakout/investors-must-lower-expectations-arnott-122138715.html

Wednesday, February 13, 2013

BCOR: Strong Q4 Results; Guidance Ahead of Expectations

Blucora (BCOR), the company we suggested on 1/29, reported strong Q4 numbers and provided Q1 guidance well ahead of consensus. The Company also announced a $50MM share buy-back program over the next 24 months; which we view as positive. Based on where it closed on Wednesday, BCOR is trading at a mere 6x total FY '13 EBITDA. The stock has reacted well to the Q4 earnings release as it was up nearly 10% in AH, at $16.54. Whether this upturn will continue throughout the day on Thursday remains to be seen. As a reminder, our valuation of the company is $19/sh.

- Total Q4 revenues came in at $97.47MM, up 46.3% Y/Y, driven mainly by 44.6% growth in the Search segment. Not surprisingly, revenues from the Tax Preparation segment in Q4, the seasonally weakest quarter, came in at only $1.17MM. For the year, top-line growth was 77.8% driven not only by the acquisition of TaxAct, but also a 50.7% growth in the Search segment.

- Search segment EBITDA margin for the quarter was 18.0%, slightly lower than the 19.2% in Q4 '11. This was mainly due to a higher portion of revenues, with lower margins, coming from distribution partners.

- Initially we were a bit too conservative as we thought that such trend in BCOR's Search revenues, in addition to changes enforced by Google (GOOG), would drive EBITDA margin to 15% in FY '13. However, based on management's guidance, it appears that management believes Search segment income margin will bottom out at slightly above 16%. We expect that BCOR's and other players' adaptation to GOOG standards over time will lead to margin expansion again, likely in late Q4 and continuing into FY '14. However, given the expected volatility surrounding this space, we stand by our 15% assumption for FY '13, which, again, appears to be very conservative.

- As expected, the Tax Preparation segment generated losses in the quarter. However, for the year, that segment's income margin was an impressive 48.4%. Management's guidance for 1H '13 indicates EBITDA margin of 52%. While we have confidence that the Company can achieve this, we believe margin for the year will be slightly lower, likely around 49%, due to expected losses in Q3 and Q4. We note that given the new services being rolled out in that segment, revenues in 2H '13 may be higher, possibly reducing losses compared to those incurred in FY '12.

We have not changed any of our assumptions or estimates as we continue to view BCOR as a value-play.

We still expect top-line growth of 12.5% in Search for the year, which is in-line with what management guided this afternoon - "low double digit" growth. As mentioned earlier, our Search EBITDA estimate is below management's guidance, but we're sticking with it given the volatility in that space. So we estimate $387.9MM and $58.2MM for FY '13 Search revenues and EBITDA, respectively. Based on management's guidance, the Street will likely be expecting EBITDA of around $64MM - $65MM for Search.

We estimate $90.5MM in FY '13 revenues for Tax Preparation, which could generate approx. $44MM in EBITDA.

Our sum-of-parts valuation, which consists of 6x Search EBITDA, 8x Tax Preparation EBITDA, plus net cash of approx. $88MM, results in a market cap of $790MM or nearly $19/sh. This represents a forward EV/EBITDA multiple of only 7.9 for the entire company, which we think will include around $13MM in unallocated corp. expenses in FY '13.

We still expect top-line growth of 12.5% in Search for the year, which is in-line with what management guided this afternoon - "low double digit" growth. As mentioned earlier, our Search EBITDA estimate is below management's guidance, but we're sticking with it given the volatility in that space. So we estimate $387.9MM and $58.2MM for FY '13 Search revenues and EBITDA, respectively. Based on management's guidance, the Street will likely be expecting EBITDA of around $64MM - $65MM for Search.

We estimate $90.5MM in FY '13 revenues for Tax Preparation, which could generate approx. $44MM in EBITDA.

Our sum-of-parts valuation, which consists of 6x Search EBITDA, 8x Tax Preparation EBITDA, plus net cash of approx. $88MM, results in a market cap of $790MM or nearly $19/sh. This represents a forward EV/EBITDA multiple of only 7.9 for the entire company, which we think will include around $13MM in unallocated corp. expenses in FY '13.

Tuesday, February 12, 2013

Facebook (FB) Cut by Bernstein to Market Perform

According to Forbes, Bernstein downgraded Facebook (FB) to market-perform after the close on Monday (2/11). It reduced its FB valuation to $27/sh from $33/sh. The article can be accessed directly from here: http://www.forbes.com/sites/ericsavitz/2013/02/11/feeling-asocial-bernstein-cuts-facebook-to-market-perform/

We note that a couple of the concerns that we mentioned at the end of Jan. were included in Bernstein's analysis on Monday: early 'impressive' growth in mobile ad revenues could be misleading; there is evidence of continuing pricing pressure from mere modest growth in price per ads even though the FB platform for ads is hyped as the one with highest potential return; and lack of enough evidence that revenues and profitability from emerging markets will grow fast enough to at least partially offset what appears to be not significant enough growth in the developed markets (North America and Europe).

Lastly, although it is considered 'old news', Stifel Nicolaus downgraded FB on 1/31.

Monday, February 11, 2013

AVID Names Louis Hernandez CEO

Avid Technology (AVID) announced this morning that Louis Hernandez, a Board member since 2008 and CEO of Open Solutions which was acquired by Fiserv last month, will be the Company's new CEO, replacing Gary Greenfield. Mr. Greenfield will stay on AVID's Board of Directors. We are not sure whether or not the timing of this announcement has anything to do with AVID's Q4 earnings results (due out on 2/26). However, given that Mr. Hernandez's previous company was acquired just recently, it appears the Board had been considering a change at the top for some time.

The stock reacted well to the news as it closed at $7.87, up 4.5% for the day. Lastly, we found a full and impressive bio of Mr. Hernandez on Open Solutions' website - http://www.opensolutions.com/about-us/executive-team/Louis_Hernandez_Jr.aspx

Thursday, February 7, 2013

IACI: Solid Q4 Results and Strong FY '13 Guidance

IAC/InterActiveCorp (IACI) reported what we believe was a strong Q4 '12. Management's confidence going forward was evident, as for the first time the Company provided more color or guidance regarding how it expects to perform in FY '13. We now value IACI at $52.00/sh. Our valuation of the Company is $0.50/sh lower mainly due to a higher share count as of the end of FY '12. Given our conservative 15% FY '13 top-line growth projection, which we think will result in margin expansion and EBITDA Y/Y growth of 28%, we are applying an EV/EBITDA of 7.5, slightly higher than the 7.0 that we mentioned in our first post. The stock had moved up approx. 6% since we mentioned it eight days ago. After the release of Q4 results, shares of IACI were down only a penny in AH trading. With quarterly dividends of $0.24/sh, IACI's dividend yield is 2.23%, which makes the stock more attractive and more of a value play.

- Total Q4 revenues of $765.3MM, which represented Y/Y and Q/Q growth of 28.1% and 7.1%, respectively, were above the Street's $758.1MM expectation. FY '12 revenues of $2,800.9MM were up 36% Y/Y.

- Q4 GAAP EPS of $0.40; adj. EPS of $0.70. Adj. EPS were below the Street's $0.78 for two reasons: 1) $11.5MM in restructuring charges, and 2) effective tax rate of 41% compared to 35% in the model. Although restructuring charges were unexpected, we do consider them as part of operations as they are not related to any discontinued operations. GAAP and adjusted EPS, including the restructuring charges but with a 35% tax rate, would have been $0.52 and $0.78, respectively; in-line with expectations. Of course, if one decides to exclude those restructuring charges from the adj. net income calculation, IACI's adj. EPS would be much higher.

- Adj. EBITDA (excl. non-cash compensation expense) for the year were $497.3MM, up 36% Y/Y. As a percentage of revenues, EBITDA remained flat compared to FY '11. Again, we think EBITDA margin will expand in FY '13. Such expansion will be driven mainly by higher margin in Match and significantly lower operating loss in Media & Other. We expect the Company to successfully cross-sell and up-sell more revenue generating services at lower costs to its current and future Match users going forward.

- Management stated it will continue its share buy-back program, if necessary. Between Oct. '12 and Feb. '13, it bought back 6.4MM shares at an average price of $45.69.

- In terms of FY '13 guidance, management expects "double-digit" revenue and operating income before amortization (OIBA) growth within the Search & Applications segment; "low double-digit" revenue and "high double-digit" OIBA growth in Match; "modest double-digit" revenue and OIBA growth in Local; and "solid double-digit" revenue growth accompanied by OIBA loss of $25MM - $30MM in Media & Other segment. Again, this was guidance for the full year.

- Q1 will likely be the weakest quarter. For example, approx. 40% of Media & Other's full-year expected OIBA loss will be in Q1. In addition, Search & Applications revenue growth will be stronger in Q2 - Q4 than what is expected in Q1.

- We believe interpretation of management's 'guidance' will vary. We did not make significant changes to our projections. For FY '13 we expect revenues of $3,212.0MM and adj. EBITDA of $636.0MM, or Y/Y growth rates of 15% and 28%, respectively.

Overall, we think IACI reported a solid Q4 and we remain confident regarding its performance in FY '13. Surprisingly, this was supported by management providing guidance for the first time on the earnings call. Our conservative valuation represents a 22% upside from where the stock closed at on Wednesday. Lastly, given the average price at which the Company repurchased its shares the last time around, the share buyback program could provide a floor at $35 - $40 per share, limiting the downside a bit.

Monday, February 4, 2013

January NFP & Mfr. ISM ...

Well, we certainly cannot claim "accuracy" to be our middle name when it comes to projecting the latest macro indicators. On Friday, January NFP came in below our estimate while ISM manufacturing blew away our what appeared to be a pessimistic type of projection.

The state of employment report for January included NFP change of +157K and the official unemployment rate of 7.9%. NFP was 18K below our estimate and the Street's. We must say that given the prior two months' significant upward revisions, our NFP estimate cannot necessarily be thought of as too optimistic. November and December NFP counts were revised up by 86K and 41K, respectively. However, as we noted last week, based on the late January initial jobless claims data, we could see a slowdown in or reversal of NFP's last few months' upward trend.

January manufacturing ISM of 53.1 certainly surpassed the Street's 50.7 and our 49.0 estimates. This was driven mainly by growth in new orders and inventories. The employment sub-index also ticked up a bit. In fact, this sub-index has been increasing for the past 40 months. Given further contraction in backlog of orders and continuing increase in customers' inventories (although not significant), we do not expect such positive impact from the inventories sub-index in the February numbers.

The week of 2/4 appears to be a bit light compared to the prior week. The only market moving macro indicators scheduled to be released are the non-manufacturing ISM (2/5) and weekly initial jobless claims (2/7).

Lastly, congrats to the Super Bowl 2013 champions, the Baltimore Ravens. We just hope the Jets will get at least an average QB one day so they could have a chance to accomplish what the Ravens just did.

The state of employment report for January included NFP change of +157K and the official unemployment rate of 7.9%. NFP was 18K below our estimate and the Street's. We must say that given the prior two months' significant upward revisions, our NFP estimate cannot necessarily be thought of as too optimistic. November and December NFP counts were revised up by 86K and 41K, respectively. However, as we noted last week, based on the late January initial jobless claims data, we could see a slowdown in or reversal of NFP's last few months' upward trend.

January manufacturing ISM of 53.1 certainly surpassed the Street's 50.7 and our 49.0 estimates. This was driven mainly by growth in new orders and inventories. The employment sub-index also ticked up a bit. In fact, this sub-index has been increasing for the past 40 months. Given further contraction in backlog of orders and continuing increase in customers' inventories (although not significant), we do not expect such positive impact from the inventories sub-index in the February numbers.

The week of 2/4 appears to be a bit light compared to the prior week. The only market moving macro indicators scheduled to be released are the non-manufacturing ISM (2/5) and weekly initial jobless claims (2/7).

Lastly, congrats to the Super Bowl 2013 champions, the Baltimore Ravens. We just hope the Jets will get at least an average QB one day so they could have a chance to accomplish what the Ravens just did.

Thursday, January 31, 2013

Economic Data Update ...

Initial Jobless Claims

This morning's initial jobless claims number was well above the consensus; 368K versus 350K. It also represents a huge 38K increase from the prior week. Without anything unusual impacting that number, it may indicate that the employment picture for the month of Feb. has gotten off to a bad start. We note that this initial jobless claims data did not impact tomorrow's to-be-released Jan. employment report. The surveys, on which the employment report is based, were conducted before this latest sample of jobless claims was taken (which was last week).

Personal Income & Outlays (December)

As we assumed earlier this week, personal income grew more than expected in the latter part of Q4. It went up 2.6% in Dec., significantly above the Street's 1.0% estimate. In terms of Y/Y, personal income grew 6.9%. However, we note that a lot of the growth in December was due to a huge uptick in special dividend and bonus payments by companies in fear of higher taxes and the fiscal cliff in 2013. For this reason, this type of growth is not likely to continue.

Consumer spending in Dec. was up 3.6% Y/Y, while the Y/Y change in headline and core PCE Price indexes, 1.3% and 1.4%, respectively, both grew 10bps less than expected. This could be considered good news by the pro-QE and pro-Bernanke folks, especially after the latest disappointing GDP report.

Chicago PMI (January)

The Chicago PMI of 55.6 comfortably beat Street's 50.0 estimate. All key sub-indexes increased nicely, with production, new orders, and employment being the notable ones. We are not yet sure if this report will have an impact on estimates of tomorrow's ISM manufacturing report, but we did not change our projection. We still expect a slight contraction, 49.0, versus the Street's pre-Chicago PMI estimate of 50.0.

This morning's initial jobless claims number was well above the consensus; 368K versus 350K. It also represents a huge 38K increase from the prior week. Without anything unusual impacting that number, it may indicate that the employment picture for the month of Feb. has gotten off to a bad start. We note that this initial jobless claims data did not impact tomorrow's to-be-released Jan. employment report. The surveys, on which the employment report is based, were conducted before this latest sample of jobless claims was taken (which was last week).

Personal Income & Outlays (December)

As we assumed earlier this week, personal income grew more than expected in the latter part of Q4. It went up 2.6% in Dec., significantly above the Street's 1.0% estimate. In terms of Y/Y, personal income grew 6.9%. However, we note that a lot of the growth in December was due to a huge uptick in special dividend and bonus payments by companies in fear of higher taxes and the fiscal cliff in 2013. For this reason, this type of growth is not likely to continue.

Consumer spending in Dec. was up 3.6% Y/Y, while the Y/Y change in headline and core PCE Price indexes, 1.3% and 1.4%, respectively, both grew 10bps less than expected. This could be considered good news by the pro-QE and pro-Bernanke folks, especially after the latest disappointing GDP report.

Chicago PMI (January)

The Chicago PMI of 55.6 comfortably beat Street's 50.0 estimate. All key sub-indexes increased nicely, with production, new orders, and employment being the notable ones. We are not yet sure if this report will have an impact on estimates of tomorrow's ISM manufacturing report, but we did not change our projection. We still expect a slight contraction, 49.0, versus the Street's pre-Chicago PMI estimate of 50.0.

Facebook Update ...

Facebook (FB) reported slightly better than expected Q4 numbers. The stock was down 3.4% in AH. We are not sure how the stock will react to the numbers on Thursday. But as we said in our prior post, it may have been priced to perfection. While the numbers came in better than expected, the same issues linger - slowdown in user growth within the most profitable region (North America), while better user growth is in regions with much lower ARPUs; monetization of users moving onto mobile devices; and the decline in average price per ad. In our opinion, FB is taking the right steps to address these issues, but it will take time to see if those moves will be considered as successful. From a fundamental standpoint, the stock remains overvalued.

Total revenues of $1.59bil, exceeded the Street's $1.52bil and our $1.49bil expectations. We note that due to some accounting adjustments, FB actually recognized $66MM more in payments & other fees revenues (one-time). Without that, total revenues would have been pretty much in-line with the consensus. FB also beat one the bottom-line, with GAAP EPS of $0.03. We actually had estimated a net loss of $0.03. We had over-estimated stock based compensation and the Company's income taxes.

Growth in North American MAU continued to slowdown. Y/Y MAU growth in that region was only 7.8%, while growth in Europe, Asia, and other regions were 14.0%, 40.6%, and 35.1%, respectively. Unfortunately, highest ARPUs came from the slowest growing region, North America. We must note that ARPU in the 'other' regions did grow north of 40% Y/Y, but it was only $0.56. In fact, revenues from that region accounted for only 10% of FB's total revenues, while revenues from North America were nearly 50%.

Based on the mobile MAU of 680MM provided by the Company, we estimate that mobile ARPUs were only around $0.45 in Q4. Although this figure is significantly above Q3's $0.25, we believe it must grow much further and much more quickly to make up for what we believe to be cannibalization of revenues generated from users on desktops or non-mobile platforms. But again, it appears that the Company is moving in the right direction.

Whether the initial success seen in News Feed on mobile will continue or not, remains to be seen. Increase in total mobile ad revenues as a percentage of overall ad revenues could be due to many companies wanting to be the first ones trying out marketing on this platform. With high expectations, such growth may not last, and/or businesses may demand a lower price per ad. So FB will need to demonstrate consistent acceleration of growth in both the number of ads on mobile platforms and mobile ARPUs. As noted before, if ads are successfully designed to target specific users, which means they could have a higher return for the advertisers, then their prices, and therefore the ARPUs will increase. However, the question of whether users will accept the ads or will reduce their time on FB, as a result of possibly too many ads, remains. The line between the push and pull ads is getting blurrier.

Also, returns on mobile ads for advertisers are a bit more difficult to measure. In our opinion, the regular click per ad may not be a good measure. We think mobile ads will be considered successful if they lead to a transaction, at that time or at a later time, and on the mobile device or in the store. However, given that most user growth is coming from developing regions which do not have the American consumption-only culture and have much lower wages and disposable income, growth of mobile ads and their ARPUs in those regions will remain very limited, in our opinion.

One of the least talked about issues surrounding FB is the fact that while ad impressions are increasing at an impressive rate, 46% Y/Y in Q4, average price per ad continues to decline. Yes, lower prices are coming mainly from lesser developing markets, but then again, so are the faster growing impressions. This is similar to the dilemma FB is facing regarding the slowdown of its user growth in the region with the highest ARPU that is also cash flow positive and is the main reason why FB was profitable.

We remain optimistic about the Company's Gift strategy and how it can actually drive impressive growth in the payments & other fees segment. Unfortunately, this will take some time and requires a lot of patience.

Again, overall, FB's Q4 results were slightly better than expected, mainly due to the one-time lift in revenues from the payments & other fees segment, along with lower stock-based compensation expenses and income taxes. The balance sheet remains strong with net cash and marketable securities of $8.13bil or $3.24/sh. However, the stock is overvalued; trading at 36x FY '13 EPS with a PEG of 1.6. A forward P/S multiple of 10 also indicates it is overpriced for the top-line growth that the market is expecting. It is also trading at nearly 20x our FY '13 EBITDA estimate. We continue to value FB at $23/sh.

Total revenues of $1.59bil, exceeded the Street's $1.52bil and our $1.49bil expectations. We note that due to some accounting adjustments, FB actually recognized $66MM more in payments & other fees revenues (one-time). Without that, total revenues would have been pretty much in-line with the consensus. FB also beat one the bottom-line, with GAAP EPS of $0.03. We actually had estimated a net loss of $0.03. We had over-estimated stock based compensation and the Company's income taxes.

Growth in North American MAU continued to slowdown. Y/Y MAU growth in that region was only 7.8%, while growth in Europe, Asia, and other regions were 14.0%, 40.6%, and 35.1%, respectively. Unfortunately, highest ARPUs came from the slowest growing region, North America. We must note that ARPU in the 'other' regions did grow north of 40% Y/Y, but it was only $0.56. In fact, revenues from that region accounted for only 10% of FB's total revenues, while revenues from North America were nearly 50%.

Based on the mobile MAU of 680MM provided by the Company, we estimate that mobile ARPUs were only around $0.45 in Q4. Although this figure is significantly above Q3's $0.25, we believe it must grow much further and much more quickly to make up for what we believe to be cannibalization of revenues generated from users on desktops or non-mobile platforms. But again, it appears that the Company is moving in the right direction.

Whether the initial success seen in News Feed on mobile will continue or not, remains to be seen. Increase in total mobile ad revenues as a percentage of overall ad revenues could be due to many companies wanting to be the first ones trying out marketing on this platform. With high expectations, such growth may not last, and/or businesses may demand a lower price per ad. So FB will need to demonstrate consistent acceleration of growth in both the number of ads on mobile platforms and mobile ARPUs. As noted before, if ads are successfully designed to target specific users, which means they could have a higher return for the advertisers, then their prices, and therefore the ARPUs will increase. However, the question of whether users will accept the ads or will reduce their time on FB, as a result of possibly too many ads, remains. The line between the push and pull ads is getting blurrier.

Also, returns on mobile ads for advertisers are a bit more difficult to measure. In our opinion, the regular click per ad may not be a good measure. We think mobile ads will be considered successful if they lead to a transaction, at that time or at a later time, and on the mobile device or in the store. However, given that most user growth is coming from developing regions which do not have the American consumption-only culture and have much lower wages and disposable income, growth of mobile ads and their ARPUs in those regions will remain very limited, in our opinion.

One of the least talked about issues surrounding FB is the fact that while ad impressions are increasing at an impressive rate, 46% Y/Y in Q4, average price per ad continues to decline. Yes, lower prices are coming mainly from lesser developing markets, but then again, so are the faster growing impressions. This is similar to the dilemma FB is facing regarding the slowdown of its user growth in the region with the highest ARPU that is also cash flow positive and is the main reason why FB was profitable.

We remain optimistic about the Company's Gift strategy and how it can actually drive impressive growth in the payments & other fees segment. Unfortunately, this will take some time and requires a lot of patience.

Again, overall, FB's Q4 results were slightly better than expected, mainly due to the one-time lift in revenues from the payments & other fees segment, along with lower stock-based compensation expenses and income taxes. The balance sheet remains strong with net cash and marketable securities of $8.13bil or $3.24/sh. However, the stock is overvalued; trading at 36x FY '13 EPS with a PEG of 1.6. A forward P/S multiple of 10 also indicates it is overpriced for the top-line growth that the market is expecting. It is also trading at nearly 20x our FY '13 EBITDA estimate. We continue to value FB at $23/sh.

Wednesday, January 30, 2013

Q4 GDP and Jan. ADP ...

Q4 GDP Shrank 0.1%

Well, the initial report on Q4 GDP certainly was not what we or the market expected. In fact, we thought that number might even be better than the 1.0% consensus. That certainly was not the case as the annualized Q4 '12 GDP growth turned out to be -0.1%, the first decline since 2009.

The main miss with respect to our estimate was that we over estimated the government spending portion. In fact, at the federal level, government spending declined at a 15% annualized rate, led by a 22.2% decline in defense spending. Declines in inventories and net exports also contributed to the disappointing Q4 GDP.

On the positive side, PCE grew 2.2%, which in our model was the driver behind our 1.2% real GDP estimate. And as we mentioned on Monday, growth in wages and disposable income was more than expected. In addition, durable goods went up nearly 14%.

Given that the US economy is a consumer driven one, the latest GDP report may not be that bad. However, decline in inventories, along with huge declines in both exports and imports, may indicate that economic growth will be limited going forward.

ADP (January)

The January ADP figure came in above estimates; 192K versus 172K. However, the December number was revised down by 30K to 185K. Most of the 192K increase was attributable to higher employment in small businesses and mainly service providers.

As a reminder, January ISM and NFP will be released on Friday. Reaction to the Q4 GDP number does not appear to be that bad, with the S&P 500 futures down around 0.2%. Given the disappointing growth, gold is up 1% as the need for continuation of QE is apparent. Lastly, NFLX is up a bit more than $3/sh as many are applauding its success in raising more debt at a lower rate to pay off some of its other debt and also pay for content.

Well, the initial report on Q4 GDP certainly was not what we or the market expected. In fact, we thought that number might even be better than the 1.0% consensus. That certainly was not the case as the annualized Q4 '12 GDP growth turned out to be -0.1%, the first decline since 2009.

The main miss with respect to our estimate was that we over estimated the government spending portion. In fact, at the federal level, government spending declined at a 15% annualized rate, led by a 22.2% decline in defense spending. Declines in inventories and net exports also contributed to the disappointing Q4 GDP.

On the positive side, PCE grew 2.2%, which in our model was the driver behind our 1.2% real GDP estimate. And as we mentioned on Monday, growth in wages and disposable income was more than expected. In addition, durable goods went up nearly 14%.

Given that the US economy is a consumer driven one, the latest GDP report may not be that bad. However, decline in inventories, along with huge declines in both exports and imports, may indicate that economic growth will be limited going forward.

ADP (January)

The January ADP figure came in above estimates; 192K versus 172K. However, the December number was revised down by 30K to 185K. Most of the 192K increase was attributable to higher employment in small businesses and mainly service providers.

As a reminder, January ISM and NFP will be released on Friday. Reaction to the Q4 GDP number does not appear to be that bad, with the S&P 500 futures down around 0.2%. Given the disappointing growth, gold is up 1% as the need for continuation of QE is apparent. Lastly, NFLX is up a bit more than $3/sh as many are applauding its success in raising more debt at a lower rate to pay off some of its other debt and also pay for content.

Tuesday, January 29, 2013

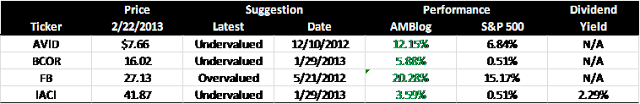

NFLX, BCOR, IACI, and AVID

We thought to touch on a few names. The following lengthy comments are based on our initial observations and not on extensive research and due diligence, which may be conducted at a later time. We have also provided a brief update on AVID at the end of this post.

Netflix (NFLX)

As everyone knows, Netflix (NFLX) has skyrocketed "to the moon", more than tripling since Oct. '12. Carl Icahn's move as an 'activist' shareholder kick started the rally. Of course, he did not take as much risk as other shareholders did once they jumped on that bandwagon, as most of his position in NFLX is in the form of call options. However, again, the ones that took the risk have certainly reaped huge returns.

NFLX's favorable Q4 earnings results also helped the situation. In addition, given that shorted shares of NFLX represented more than 25% of the float, Icahn's move and the better than expected earnings created a very nice short squeeze, pushing the stock even higher. Now, we think NFLX is overvalued.

Whether it is yet 'safe' to short it remains to be seen as it takes some time for the impact of a short squeeze to 'evaporate'. However, the huge $60+ gap, or 60%, created will more than likely have to be filled, increasing the chances of a pullback. Another indicator may be the volume. It has averaged nearly 4x its daily average in four out of the last five trading days, indicating a lot of short covering. Easing of the volume while stock is still going up slightly may indicate that the short covering is coming to an end. We note that this stock is a risky one. Although the Company remains at the mercy of content providers with continuously less control over its pricing, the emotional attachment that many retail investors have to this stock does create a risk for the doubters.

On the fundamental side, we note that while NFLX's streaming subscriber growth came in better than expected, its DVD segment continued to decline, which was not surprising. Various studies indicate that the DVD market was flat Y/Y in 2012, making a Y/Y decline in 2013 and beyond very likely. In FY '12, 31% of NFLX's total revenues were from the DVD segment. Its US DVD business has a 45% - 50% margin while the streaming business margin is at around 20%. The Company is apparently taking steps to slow down the decline in DVDs. In fact, we recently received a marketing email from NFLX for its DVDs; the first time in a very very long time. Of course, similar to many other streaming subscribers, we automatically deleted the email. We note that while paid DVD subs declined 27% Y/Y in FY '12, paid streaming subs went up only 26%.

By the way, NFLX raised another $500MM so it can pay off some of its near term debt and also make some initial payments for the ever more expensive content. The good Q4 results were very timely, in our opinion.

NFLX is currently trading at 61.7x FY '13 EPS, which, based on a 5-year CAGR, represents a PEG of 31.1! Coinstar (CSTR), the maker of Redbox DVD kiosks, is trading at only 10.2x forward EPS, representing a mere 0.61 PEG. Also, CSTR's P/S is below 1.0. Some of this valuation discount is based on the fact that most of CSTR's revenues come from the mature and no-longer growing DVD market. However, we note that the DVD kiosk market is a niche which will likely not decline this year or next. In addition, CSTR has partnered with Verizon to launch Redbox Instant, which is basically a content streaming service (only movies for now), accessible on TVs, desktops, and mobile products. Redbox Instant also does not face the risk of too much upfront payment or basically inventory for content as does NFLX. Studios are paid based on CSTR's sub count and demand for titles. It appears that CSTR's Redbox Instant, a potential competitor to NFLX on the content side and pricing, is valued at $0.00 within CSTR's stock price. We are not necessarily being bullish on CSTR. We are just demonstrating how overvalued NFLX is. Lastly, and not surprisingly, based on a variety of valuation multiples, NFLX is also trading at a very high and not necessarily justifiable premium to cable and satellite companies such as Comcast (CMCSA), Time Warner Cable (TWC), DirecTV (DTV), and Dish (DISH).

Blucora (BCOR)

Blucora (BCOR), formerly known as Infospace, provides Internet search services along with tax preparation solutions (through the acquisition of TaxAct in Jan. '12). By doing a back of the envelope sum-of-parts valuation, BCOR appears to be undervalued. We think it could be worth close to $19/sh.

Both of its businesses are profitable. Its search segment top-line has grown impressively the last 12 - 24 months, driven mainly by bringing in new partners and performance of Google (GOOG), which is one of BCOR's two main partners. The other is Yahoo! (YHOO). With revenue growth of around 12.5% (a discount to the market's sentiment on search growth in CY '13), a 15% EBITDA margin and a conservative EBITDA multiple of 6.0, we think BCOR's search segment (excl. net cash) can be valued at approx. $345MM.

The tax preparation segment is very seasonal but much more profitable. Although a slight loss is expected in Q4 '12 (due to seasonality), we think that segment will generate around $44MM in EBITDA in FY '13. Other players in this space, such as H&R Block (HRB) and Intuit (INTU), with lower EBITDA margins, are trading at 8x and 12x forward EBITDA, respectively. Being conservative and applying EBITDA multiple of 8.0 to BCOR's tax services segment, gives us a valuation of $352MM for that segment. We note that 8x EBITDA is only slightly above the 7.6x EBITDA that the Company paid for the business in January of last year. In addition, there may be a slight upside to tax preparation top-line growth given that Congress recently passed the American Taxpayer Relief Act. The ever so slow improvement of the state of employment during the last 12 months, which resulted in more people receiving paychecks, therefore required to file taxes, may also help BCOR's tax preparation segment revenues.

Together, the two segments result in an EV of $697MM. With net cash of $76.1MM on BCOR's balance sheet, the Company's valuation could be around $775MM or close to $19/sh, representing around a 26% upside.

BCOR will be reporting Q4 results on 2/15. Given the Q4 numbers from GOOG and YHOO, BCOR's search revenue will be close to $93MM. Revenues from tax services will likely be around $1MM for the quarter. Management guided for EBITDA of $10MM - $11MM in Q4, which we think will be met.

The stock has traded within the range of $10.73 - $18.63 during the last 12 months. After going above $18.00, it came down abruptly to $15.00 and further down to $14.00 mainly due to the Company's disappointing Q4 guidance. The stock closed at $15.13 today. The recent upturn was driven mainly by GOOG and YHOO earnings results, along with seasonally positive expectations regarding the tax season which is in the current quarter, Q1.

Netflix (NFLX)

As everyone knows, Netflix (NFLX) has skyrocketed "to the moon", more than tripling since Oct. '12. Carl Icahn's move as an 'activist' shareholder kick started the rally. Of course, he did not take as much risk as other shareholders did once they jumped on that bandwagon, as most of his position in NFLX is in the form of call options. However, again, the ones that took the risk have certainly reaped huge returns.

NFLX's favorable Q4 earnings results also helped the situation. In addition, given that shorted shares of NFLX represented more than 25% of the float, Icahn's move and the better than expected earnings created a very nice short squeeze, pushing the stock even higher. Now, we think NFLX is overvalued.

Whether it is yet 'safe' to short it remains to be seen as it takes some time for the impact of a short squeeze to 'evaporate'. However, the huge $60+ gap, or 60%, created will more than likely have to be filled, increasing the chances of a pullback. Another indicator may be the volume. It has averaged nearly 4x its daily average in four out of the last five trading days, indicating a lot of short covering. Easing of the volume while stock is still going up slightly may indicate that the short covering is coming to an end. We note that this stock is a risky one. Although the Company remains at the mercy of content providers with continuously less control over its pricing, the emotional attachment that many retail investors have to this stock does create a risk for the doubters.

On the fundamental side, we note that while NFLX's streaming subscriber growth came in better than expected, its DVD segment continued to decline, which was not surprising. Various studies indicate that the DVD market was flat Y/Y in 2012, making a Y/Y decline in 2013 and beyond very likely. In FY '12, 31% of NFLX's total revenues were from the DVD segment. Its US DVD business has a 45% - 50% margin while the streaming business margin is at around 20%. The Company is apparently taking steps to slow down the decline in DVDs. In fact, we recently received a marketing email from NFLX for its DVDs; the first time in a very very long time. Of course, similar to many other streaming subscribers, we automatically deleted the email. We note that while paid DVD subs declined 27% Y/Y in FY '12, paid streaming subs went up only 26%.

By the way, NFLX raised another $500MM so it can pay off some of its near term debt and also make some initial payments for the ever more expensive content. The good Q4 results were very timely, in our opinion.

NFLX is currently trading at 61.7x FY '13 EPS, which, based on a 5-year CAGR, represents a PEG of 31.1! Coinstar (CSTR), the maker of Redbox DVD kiosks, is trading at only 10.2x forward EPS, representing a mere 0.61 PEG. Also, CSTR's P/S is below 1.0. Some of this valuation discount is based on the fact that most of CSTR's revenues come from the mature and no-longer growing DVD market. However, we note that the DVD kiosk market is a niche which will likely not decline this year or next. In addition, CSTR has partnered with Verizon to launch Redbox Instant, which is basically a content streaming service (only movies for now), accessible on TVs, desktops, and mobile products. Redbox Instant also does not face the risk of too much upfront payment or basically inventory for content as does NFLX. Studios are paid based on CSTR's sub count and demand for titles. It appears that CSTR's Redbox Instant, a potential competitor to NFLX on the content side and pricing, is valued at $0.00 within CSTR's stock price. We are not necessarily being bullish on CSTR. We are just demonstrating how overvalued NFLX is. Lastly, and not surprisingly, based on a variety of valuation multiples, NFLX is also trading at a very high and not necessarily justifiable premium to cable and satellite companies such as Comcast (CMCSA), Time Warner Cable (TWC), DirecTV (DTV), and Dish (DISH).

Blucora (BCOR)

Blucora (BCOR), formerly known as Infospace, provides Internet search services along with tax preparation solutions (through the acquisition of TaxAct in Jan. '12). By doing a back of the envelope sum-of-parts valuation, BCOR appears to be undervalued. We think it could be worth close to $19/sh.

Both of its businesses are profitable. Its search segment top-line has grown impressively the last 12 - 24 months, driven mainly by bringing in new partners and performance of Google (GOOG), which is one of BCOR's two main partners. The other is Yahoo! (YHOO). With revenue growth of around 12.5% (a discount to the market's sentiment on search growth in CY '13), a 15% EBITDA margin and a conservative EBITDA multiple of 6.0, we think BCOR's search segment (excl. net cash) can be valued at approx. $345MM.

The tax preparation segment is very seasonal but much more profitable. Although a slight loss is expected in Q4 '12 (due to seasonality), we think that segment will generate around $44MM in EBITDA in FY '13. Other players in this space, such as H&R Block (HRB) and Intuit (INTU), with lower EBITDA margins, are trading at 8x and 12x forward EBITDA, respectively. Being conservative and applying EBITDA multiple of 8.0 to BCOR's tax services segment, gives us a valuation of $352MM for that segment. We note that 8x EBITDA is only slightly above the 7.6x EBITDA that the Company paid for the business in January of last year. In addition, there may be a slight upside to tax preparation top-line growth given that Congress recently passed the American Taxpayer Relief Act. The ever so slow improvement of the state of employment during the last 12 months, which resulted in more people receiving paychecks, therefore required to file taxes, may also help BCOR's tax preparation segment revenues.

Together, the two segments result in an EV of $697MM. With net cash of $76.1MM on BCOR's balance sheet, the Company's valuation could be around $775MM or close to $19/sh, representing around a 26% upside.

BCOR will be reporting Q4 results on 2/15. Given the Q4 numbers from GOOG and YHOO, BCOR's search revenue will be close to $93MM. Revenues from tax services will likely be around $1MM for the quarter. Management guided for EBITDA of $10MM - $11MM in Q4, which we think will be met.

The stock has traded within the range of $10.73 - $18.63 during the last 12 months. After going above $18.00, it came down abruptly to $15.00 and further down to $14.00 mainly due to the Company's disappointing Q4 guidance. The stock closed at $15.13 today. The recent upturn was driven mainly by GOOG and YHOO earnings results, along with seasonally positive expectations regarding the tax season which is in the current quarter, Q1.

IAC/InterActiveCorp (IACI)

IAC (IACI), which basically consists of a variety of Internet companies, appears to be undervalued and at $40.65, the stock is not far from its 52-week low of $38.20. It is trading at only 5.2x FY '13 EBITDA. We think IACI could be worth $52.50/sh, or 7x FY '13 EBITDA plus net cash of approx. $545MM. The Company is profitable and cash flow positive. It is also experiencing organic top-line growth in addition to growth via acquisitions. While it is heavily dependent on big players in the search space such as GOOG, we think it can maintain its agreements with GOOG. In addition, our estimates do take into account the possibility of limited margin expansion if GOOG were to increase its prices. This is from our initial look at IACI. We will provide updates as we conduct due diligence and complete a more detailed model. We note IACI distributes quarterly dividends, which are currently yielding 2.4%.

IAC's various Internet businesses are grouped into four segments: search & applications, Match, Local, and Media & Other.

From a macro standpoint, even with basically one dominant player in the Internet search space, GOOG, other smaller players continue to benefit as the overall space keeps growing. What initially attracted us to IACI was that we realized it takes time to think about the right keywords to search or 'Google' for. So, obviously on our smartphone, which we now utilize much more often than our desktop or laptop, we started typing in simple questions. The results which we found simple, straight to the point and of course most helpful were the ones from Ask.com and ehow.com. Ask.com is one of the companies owned by IACI. eHow.com is owned by Demand Media (DMD), which we also view as attractive but not as cheap as IACI. We think this type of search is becoming more popular every day. IACI consolidates data from a variety of sources to create a useful Ask.com database. And last year it bought About.com which we believe can help improve answers to questions asked in Ask.com, which may also help expand margins a bit. We note that there is a lot of competition in this space (incl. DMD), but IACI appears to be doing just fine. Dictionary.com is another one that we see come up often when we search for definition of words or phrases. It is also owned by IACI.

The Match segment is basically online dating. Most of its revenues is derived from subscription to the popular Match.com online dating services site, and also from ads on that site. Some revenues also come from a European version of Match.com, Meetic. The Company also owns about one fifth of an online matchmaking service provider in China. Revenue growth of Match will likely not be very robust; however, it is the Company's most profitable segment. Slowdown in revenue growth is due mainly to competition such as Facebook (FB) and the fact that the online dating space has pretty much become a mature market. However, we think that there is a chance where some FB users would rather pay a bit to be on Match.com and find new 'friends' rather than have their private information available to their FB friends, a high percentage of which are likely not true friends. As FB friends continue to get more tools to 'investigate' each other's behavior (such as Graph Search), Match's slightly more private service may become attractive again for users. We think FB's performance over the last couple of months has impacted IACI's stock negatively.

The Local segment consists of marketplaces connecting people with local service professionals. HomeAdvisor.com is one of its main websites. It helps many find home improvement advice and services from local professionals. Given what many believe to be the recovery or bounce from the bottom within the real estate market, such a marketplace could get high traffic. Revenues are generated mainly from local businesses paying fees to be listed on the site. IACI also gets paid if a user decided to schedule an appointment with one of the local businesses via the site. According to the Company, IACI gets paid no matter if the user receives the business' service and pays for it or not. There is a lot of competition in this space. It includes Yelp (YELP) and now FB. But the space is also growing so most players will likely benefit.

And finally, the Media & Other segment includes CollegeHumor Media, and Newsweek & The Daily Beast. It also has Vimeo, where users watch, share and upload video. This segment is burning cash this year (mainly due to restructuring related to Newsweek) and will most likely do so next year, although a bit less, which may help create upside to overall margins.

IAC (IACI), which basically consists of a variety of Internet companies, appears to be undervalued and at $40.65, the stock is not far from its 52-week low of $38.20. It is trading at only 5.2x FY '13 EBITDA. We think IACI could be worth $52.50/sh, or 7x FY '13 EBITDA plus net cash of approx. $545MM. The Company is profitable and cash flow positive. It is also experiencing organic top-line growth in addition to growth via acquisitions. While it is heavily dependent on big players in the search space such as GOOG, we think it can maintain its agreements with GOOG. In addition, our estimates do take into account the possibility of limited margin expansion if GOOG were to increase its prices. This is from our initial look at IACI. We will provide updates as we conduct due diligence and complete a more detailed model. We note IACI distributes quarterly dividends, which are currently yielding 2.4%.

IAC's various Internet businesses are grouped into four segments: search & applications, Match, Local, and Media & Other.

From a macro standpoint, even with basically one dominant player in the Internet search space, GOOG, other smaller players continue to benefit as the overall space keeps growing. What initially attracted us to IACI was that we realized it takes time to think about the right keywords to search or 'Google' for. So, obviously on our smartphone, which we now utilize much more often than our desktop or laptop, we started typing in simple questions. The results which we found simple, straight to the point and of course most helpful were the ones from Ask.com and ehow.com. Ask.com is one of the companies owned by IACI. eHow.com is owned by Demand Media (DMD), which we also view as attractive but not as cheap as IACI. We think this type of search is becoming more popular every day. IACI consolidates data from a variety of sources to create a useful Ask.com database. And last year it bought About.com which we believe can help improve answers to questions asked in Ask.com, which may also help expand margins a bit. We note that there is a lot of competition in this space (incl. DMD), but IACI appears to be doing just fine. Dictionary.com is another one that we see come up often when we search for definition of words or phrases. It is also owned by IACI.

The Match segment is basically online dating. Most of its revenues is derived from subscription to the popular Match.com online dating services site, and also from ads on that site. Some revenues also come from a European version of Match.com, Meetic. The Company also owns about one fifth of an online matchmaking service provider in China. Revenue growth of Match will likely not be very robust; however, it is the Company's most profitable segment. Slowdown in revenue growth is due mainly to competition such as Facebook (FB) and the fact that the online dating space has pretty much become a mature market. However, we think that there is a chance where some FB users would rather pay a bit to be on Match.com and find new 'friends' rather than have their private information available to their FB friends, a high percentage of which are likely not true friends. As FB friends continue to get more tools to 'investigate' each other's behavior (such as Graph Search), Match's slightly more private service may become attractive again for users. We think FB's performance over the last couple of months has impacted IACI's stock negatively.

The Local segment consists of marketplaces connecting people with local service professionals. HomeAdvisor.com is one of its main websites. It helps many find home improvement advice and services from local professionals. Given what many believe to be the recovery or bounce from the bottom within the real estate market, such a marketplace could get high traffic. Revenues are generated mainly from local businesses paying fees to be listed on the site. IACI also gets paid if a user decided to schedule an appointment with one of the local businesses via the site. According to the Company, IACI gets paid no matter if the user receives the business' service and pays for it or not. There is a lot of competition in this space. It includes Yelp (YELP) and now FB. But the space is also growing so most players will likely benefit.

And finally, the Media & Other segment includes CollegeHumor Media, and Newsweek & The Daily Beast. It also has Vimeo, where users watch, share and upload video. This segment is burning cash this year (mainly due to restructuring related to Newsweek) and will most likely do so next year, although a bit less, which may help create upside to overall margins.

AVID Update ...

AVID increased 17%+ after we posted our thoughts on it in early Dec. However, it has declined approx. 10% recently. We think the pullback was partially due to profit-taking and minimizing risk going into Q4 earnings which will be released on 2/26. We note that even with the recent decline, the stock has slightly outperformed S&P 500 since 12/10.

Monday, January 28, 2013

Week Filled with Market Moving Economic Indicators

This week will be a busy one with many market moving macro data scheduled to be released. We quickly updated our models. Our estimates are provided below. We note that we do have a few thoughts on three particular stocks, two of which we believe may be value plays. We are looking into them and will likely post our initial thoughts sometime this week.

Q4 '12 GDP

We believe initial Q4 GDP may surprise a bit to the upside. We have projected an annualized growth rate of 1.2%, slightly above the Street's 1.0% estimate. Given what we believe to be a higher than expected increase in wages and disposable income in the latter part of Q4, in addition to improvements in manufacturing and state of employment, we think GDP may come in higher than the 1.0% consensus. The Street's somewhat conservative estimate may be due to the surprising upwardly revised Q3 GDP of 3.1%. Many don't think the Q/Q growth rate will be high enough to give an annualized rate higher than 1.0%. Q4 GDP will be released on 1/30 (Thursday).

ISM Manufacturing (January)

January's ISM manufacturing index will be released on Friday, 2/1. Overall, economists do not expect any change from the prior month. The average of their estimates stands at 50.7. We believe ISM is more likely to come in below 50.0, or around 49.0, indicating contraction in manufacturing for the month of January. Contraction was evident in nearly all regional manufacturing survey results conducted by some of the regional Reserve Banks. The only one that showed significant enough improvement was the survey of the Federal Reserve Bank of Dallas. However, our model spit out an estimate of approx. 49.0 even after taking into account those improvements.

State of Employment (January)

The official monthly employment report is also scheduled to be released on Friday. The Street is expecting an increase of 185K in the NFP figure, with which we agree. Improvements in weekly initial jobless claims (although partially due to the application of favorable weekly seasonal factors, especially for the second and third week of Jan.) and the avoidance of the fiscal cliff, for the time being, we believe may have helped increase confidence of businesses and government agencies, possibly resulting in additional hiring. We note that the ADP employment indicator is one of the factors in our model. We used the Street's ADP estimate of a 172K increase for January.

Q4 '12 GDP

We believe initial Q4 GDP may surprise a bit to the upside. We have projected an annualized growth rate of 1.2%, slightly above the Street's 1.0% estimate. Given what we believe to be a higher than expected increase in wages and disposable income in the latter part of Q4, in addition to improvements in manufacturing and state of employment, we think GDP may come in higher than the 1.0% consensus. The Street's somewhat conservative estimate may be due to the surprising upwardly revised Q3 GDP of 3.1%. Many don't think the Q/Q growth rate will be high enough to give an annualized rate higher than 1.0%. Q4 GDP will be released on 1/30 (Thursday).

ISM Manufacturing (January)

January's ISM manufacturing index will be released on Friday, 2/1. Overall, economists do not expect any change from the prior month. The average of their estimates stands at 50.7. We believe ISM is more likely to come in below 50.0, or around 49.0, indicating contraction in manufacturing for the month of January. Contraction was evident in nearly all regional manufacturing survey results conducted by some of the regional Reserve Banks. The only one that showed significant enough improvement was the survey of the Federal Reserve Bank of Dallas. However, our model spit out an estimate of approx. 49.0 even after taking into account those improvements.

State of Employment (January)

The official monthly employment report is also scheduled to be released on Friday. The Street is expecting an increase of 185K in the NFP figure, with which we agree. Improvements in weekly initial jobless claims (although partially due to the application of favorable weekly seasonal factors, especially for the second and third week of Jan.) and the avoidance of the fiscal cliff, for the time being, we believe may have helped increase confidence of businesses and government agencies, possibly resulting in additional hiring. We note that the ADP employment indicator is one of the factors in our model. We used the Street's ADP estimate of a 172K increase for January.

Wednesday, January 16, 2013

Facebook (FB) Update ...

As a reminder, in May of last year we valued Facebook (FB) at $23/sh. The stock has certainly gone on a wild ride. After an IPO pricing of $38, the stock closed flat at on the first day of trading on 5/18. From there, it went down to $25 and slightly recovered to around $32, but it was downhill after that, as the stock hit an all-time low of $17.55 on 9/4. We were pretty much satisfied with our call given the stock's disappointing performance (disappointing to the ones that marketed it so much). However, unfortunately, even after it went 24% below our valuation, we did not begin pumping it, as the stock has jumped 72% since and closed at $30.10 on Tuesday.

The latest driver of such an upturn was the much-hyped announcement that FB's CEO, Mark Zuckerberg, was scheduled to make on Tuesday. Well, he did, and although the announcement was one of another innovation, it did not provide more color on whether or not the Company has taken steps to increase revenue growth and margin expansion in the short and medium term. Mr. Zuckerberg basically described how FB will continue to invade every user's privacy by allowing 'friends' (as defined by FB) to conduct "graph search" on each other using various dimensions as filters, such as pictures, locations, likes, comments, promotions, and so forth. The search allows FB users to feel like data analysts as they analyze each of their friend's 'movements' within the FB world using tables, charts, and pictures. We think this will certainly help create millions, if not billions, of active FB investigators!

But let's put aside the jokes for a second. This 'unique' idea is very similar to what Google (GOOG) has been trying to do with its Google+ social network. If successful, FB's new service will not only benefit advertisers by helping them target FB users more effectively, therefore possibly increasing returns on their ads, it may also create problems for other social networking service providers such as LinkedIn (LNKD), Yelp (YELP) and even online dating sites, as many others have already reported. This basically takes the 'word of mouth' concept to another level. Of course, we believe that if FB users want to get the same benefits from FB as they do from LNKD, then they better start thinking twice before posting 'non-professional' pictures and comments. And if they do that, then we, and they, may ask "what's the fun in that?" We must also say that such service will certainly up the probabilities of stalking on FB, which is the last thing FB users want to see. The stock declined after the announcement and closed down 2.7%.

The next event that could move the stock is the Company's Q4 earnings announcement, scheduled for Jan. 30, after the close. And this reminds us of a question that we kept asking on Tuesday: why make an announcement about a product that is not yet fully released a couple of weeks before the FY '12 year-end earnings announcement? There are many 'glass is half full' and 'glass is half empty' answers to this question.

Regarding Q4 earnings, we expect total revenues of $1.49bil, up 31.5% Y/Y and 17.7% q/q. The Street is expecting total revenues of $1.52bil. Such growth, we believe, is driven by the seasonal increase (Christmas, etc.) of the number of ads placed, in addition to a bit less tension surrounding macro dilemmas and the question of economic recovery. Regionally, we continue to believe that while the number of users in Asia and other regions will grow faster than those in North America and Europe, ARPU's of those will remain low, therefore the North American region will continue to represent the biggest chunk of revenues. Faster adoption of FB services in the North American region will help grow that region's top-line. In addition, we think North America payments & other fees revenues will surprise to the upside as FB's Gifts and other programs will likely help offset most of the declining revenues from Zynga.

Stock based compensation will represent a big chunk of the Company's operating expenses, likely around $190MM or 18% of opex. We expect GAAP net loss of $63MM or $0.03 per share. Excluding stock based compensation and tax adjustments, we project non-GAAP net income of $368MM or $0.14 per share, a penny below the Street's estimate.

As everyone knows, FB management's comments on mobile revenues are what many will focus on. On the Q3 call, management was very optimistic about mobile revenues. However, while growth in mobile ad revenues could be impressive, we would like to get more color on whether or not such growth is coming at the expense of desktop ad revenues; and if so, can it continue to expand and/or be maintained, or will such cannibalization of desktop revenues prove too costly for the Company?

While generating revenues from mobile ads may satisfy some on the Street, we question whether it can continue. We agree that more and more users access FB from their smartphones, but given the limited space on the screens, and likely less attention span provided by users when on mobile platforms, will mobile ads actually provide better returns for advertisers in the long-run?

In addition, while FB management boasts about the higher clicks that ads placed on News Feed get, we wonder if it is due to the "fat-finger" problem that many mobile users face when clicking or typing on their smartphones, as an analyst suggested on the last earnings call. This sounds a bit unusual, but we think it is a valid question. Also, we wonder where else besides on the News Feed, which is in the middle of the FB page and between all postings of FB 'friends', would FB place the ads? There is no other available space on the mobile platform. In our opinion, this discounts management's exuberance regarding the early returns it has seen on mobile ads.

Regarding the number of ads and their pricing, we hope to see a bit higher price increase along with growth in the number of ads placed during the quarter. We say this because if mobile ads are turning out to be as effective as management has stated, then not only demand for the number of those ads should increase, but so should their prices. In Q3, while the number of ads jumped nicely by 27%, the average price per ad was up only 7%. If this continues, it could be an indication of ad commoditization, which would not necessarily be good news because FB would have to keep upping the number of ads more and more to maintain top-line growth. This could be doable, but it comes at the risk of driving away users. Higher prices will indicate if FB is placing "better ads in the feed" as management claims.

We finally updated our model with FY '12 Q2 and Q3 numbers. We also added FY '17 estimates in order to use a 5-year DCF model to value FB. It turns out that our valuation is still around $23/sh. From a technical standpoint, the stock has jumped more than 20% in two weeks, so we think that gap needs to get filled before it can peak at around $33/sh. While many may continue to hold on to FB, we note that many analysts covering this stock have upped their expectations and valuation, which has created additional risk going into the earnings announcement, again scheduled for 1/30. If the stock does give back some of its gains, the next support level is around $26. Although the stock declined a bit after the announcement, it appears that a very good earnings call is still priced into the stock, which could make the reaction to a disappointing call ... well ... disappointing.

Tuesday, January 15, 2013

Dec. Industrial Production and Capacity Utilization Expectations

Industrial production and capacity utilization for December will be released tomorrow morning at 10am (ET). We believe tomorrow's numbers may include somewhat of a lagging impact of Sandy. This was not apparent in the November numbers, so we could see that tomorrow. We estimate the industrial production index to come in at 97.0%, a 0.5% decline from November. The consensus stands at 97.7%, an increase of 0.2%. Although the ISM employment sub-indexes improved in Dec., given the work week figures of most regional surveys, along with other production indicators, we expect a slight decline in capacity utilization. Our projection stands at 78.0%, a 0.4% sequential decline. The Street is expecting 78.5% or a 0.1% increase.

Monday, January 7, 2013

"Beware the 'central bank put'" (FT)

As the Financial Times puts it: "Mohamed El-Erian asks how far central banks can divorce prices from fundamentals". In this recently published article, PIMCO's Mr. El-Erian basically says the same thing we've been trying to say for a while; except he says it in a much simpler and straight to the point way. Enjoy! http://www.ft.com/intl/cms/s/0/bb66425c-54cf-11e2-89e0-00144feab49a.html#axzz2HIabb7M4

Sunday, January 6, 2013

Some Thoughts on the Employment Report ...

Even after a very positive ADP data on Thursday, the 'official' report on the state of employment for December released on Friday was merely in-line. In addition, 30K of that 155K additional NFPs were in construction. This may appear to be positive, but we believe it may have been driven by the storm Sandy, which certainly does require extensive re-building.

We came across a few interesting things in the household survey data. It appears that the trend in duration of unemployment is changing course. While the number of people being unemployed for 27+ weeks declined (some may have left the labor force), unemployment in shorter durations (less than 5 weeks, 5-14 weeks, and 15-26 weeks) increased by an average of nearly 80K in each duration. Discouraged workers also increased; 89K from the prior month and 123K from Dec. '11.

Going back to the establishment survey data, we must say that it was positive overall. Weakness was mostly apparent on the retail side which we think was seasonally driven. However, it may also indicate lack of confidence regarding consumer spending growth going into the New Year, which includes a slight decline in disposable income for most Americans. Strength was seen in the education & health services sector which added 65K jobs. Average weekly hours, and hourly and weekly earnings also increased, slightly.

We thought to take a look at the ISM reports published before December's state of employment. While manufacturing ISM index finally, and barely, moved above 50.0 (50.7), there was no change in new orders and the production sub-index declined. With this data in mind, it was good news to see the employment sub-index move up sharply to 52.7 from 48.4 in Nov. However, we are skeptical that such data may be indicating long-term job growth in manufacturing, as customers' inventories went up sharply (although they remained in contraction mode), and backlog of orders also were contracting (below 50.0), although that particular sub-index did increase by 7.5 points to 48.5. In addition, a decline in manufacturers’ inventories, combined with the data cited above, backs up our assumption that skepticism regarding the long-run persists among manufacturers, which does cast some doubt on whether that employment sub-index will continue to grow in the coming months.

The non-manufacturing ISM report was also positive regarding the employment dilemma. That report's employment sub-index shot up 6.0 from the prior month to 56.3, indicating solid growth. The new orders sub-index also increased, but overall business activities declined slightly. In addition, backlog of orders went into the contraction mode, below 50.0, while inventories grew. These figures also cast some doubt on whether or not growth in employment will continue, but for the time being, good news is ... good news.

Overall, while most of the latest economic data showed improvement in the state of employment, we note that political, financial and economic obstacles remain. And given just how far and quickly the equity market jumped post the so-called fiscal cliff resolution, we could see some profit taking, at least in the short term, in order to create risk-neutral positions going into the additional upcoming political, financial and economic dilemmas.

Thursday, January 3, 2013

Happy New Year ... and our Dec. NFP projection

First, we would like to wish everyone a Happy New Year. Our lawmakers certainly did that with the passing of the so-called resolution to the fiscal cliff late Tuesday night. The equity market applauded Congress for such hard work by jumping more than 2%. The President signed it into law earlier tonight.

Regarding some recent macro data, the Dec. manufacturing ISM surprised on the upside, and included an employment index at its highest level in three months. In addition, we have seen downtrending weekly initial jobless claims after the initial impact of the Sandy storm. Regional business surveys are also showing a slight improvement in their employment indexes.

However, based on our model, we believe this Friday's December employment numbers will come in a bit short of the consensus. Economists estimate an increase of 155K in Dec. NFP. We think that figure will be closer to 130K.

Regarding our latest published opinion on specific stocks, we note that AVID has moved up approx. 17% since we posted our $9/sh valuation on the Company. It closed on Wednesday at $7.99/sh. We must also note that FB has moved up to $28/sh after it dipped to below $18 in early Sept. As a reminder, we valued FB at $23/sh in May. FB is trading at 42x FY '13 EPS. Analysts expect EPS growth to bounce back up to 26%+ after estimating that they grew merely 20% in FY '12. In its Dec. quarter earnings report, FB is expected to show significant improvement in generating revenues from mobile ads. Any slight disappointment could drive the stock back down to $25/sh. FB and AVID are expected to report their latest quarterly results on 1/23 and 2/4, respectively.

Friday, December 14, 2012

Ind. Production & Capacity Utilization Beat Estimates

Both industrial production and capacity utilization for Nov. came in above consensus and certainly above our projections. This could be due to a dead-cat bounce in production after a slight downturn in Oct. caused by Sandy. We note that the Oct. m/m production change was revised down by 30bps. Higher capacity util. along with some improvement in initial jobless claims could be indicating a slightly better Dec. jobs report. However, we do not anticipate an upturn significant enough to satisfy the Fed's 6.5% unemployment rate anytime soon.

Thursday, December 13, 2012

Mixed Economic News ...

Some mixed economic news this morning:

- The good news was that initial jobless claims came in at 343K, significantly below the 370K consensus. Of course, the previous week's figure was revised higher by 2K. Overall, news of initial claims below 350K is a bit encouraging. The last time that the seasonally adjusted initial claims were below 350K was in early Oct. We note that such good news could ease the excitement over another Fed QE.

- The less encouraging news consisted of Nov. PPI falling 0.8%, more than the economists' 0.5% decline estimate. Core PPI, which excludes food & energy, increased 0.1%, but still below the 0.2% consensus. But do not be fooled. While energy costs declined 4.6%, food costs increased 1.3% in Nov. We do not consider this good news. Although volatility is expected in food & energy PPI, we note that Nov.'s 1.3% increase in food inflation followed a 0.4% increase in Oct. By the way, food is a necessity.

- Nov. retail sales numbers were mixed. Overall, they increased by 0.3%, below the 0.6% consensus. However, excluding auto and gas, retail sales went up 0.7%, beating the 0.5% estimates. This was driven mainly by a 2.5% increase in sales at electronics & appliance stores, which we think is partially due to the upcoming Christmas Holidays and to the rebuilding going on post-Sandy. By the way, speaking of electronic stores, BBY (Best Buy Co.) is up nearly 18% in pre-market. It appears that auto sales did not recover as quickly as economists thought. Excluding only autos, Nov. retail sales were flat, meeting expectations. Total motor vehicles & parts dealers' sales went up 1.4% in Nov., not nearly as healthy of a gain as Oct.'s 5.4%.

CPI and industrial production & capacity utilization will be reported tomorrow morning. We posted our projections of the last two earlier this week. S&P 500 futures are pretty much flat, while gold has dipped below $1700 and front month oil futures are down slightly, trading at $86.6.

Director Purchases 20K AVID Shares

According to two SEC Form 4 filings yesterday, Robert M. Bakish (President & CEO of Viacom's Viacom International Media Networks, and currently sitting on AVID's board) purchased 10K shares of AVID on 11/28 at an average price of $6.28/sh. He purchased another 10K this week, Monday (12/10), at an average price of $6.82/sh. With these latest transactions, Mr. Bakish more than doubled the number of AVID common stock that he owns. He now owns 36K AVID shares according to the last filing. As a reminder, we posted our thoughts on AVID on 12/10.

Wednesday, December 12, 2012

Biggest Issue: Wage & Income Growth Stagnation for Most Americans

We've pointed out many times that stagnation of growth in wages for most Americans is one of the biggest issues facing this consumer driven economy. This morning, Wednesday 12/12/12, at 10:10AM (ET), The Atlantic posted a much simpler way of saying the same thing on its site. Enjoy ...

A Giant Statistical Round-up of the Income Inequality Crisis in 16 Charts.

http://www.theatlantic.com/business/archive/2012/12/a-giant-statistical-round-up-of-the-income-inequality-crisis-in-16-charts/266074/

A Giant Statistical Round-up of the Income Inequality Crisis in 16 Charts.

http://www.theatlantic.com/business/archive/2012/12/a-giant-statistical-round-up-of-the-income-inequality-crisis-in-16-charts/266074/

Monday, December 10, 2012

Avid Technology, Inc. (AVID)

We believe we have come across a value play. Although the stock has moved up 10%+ during the last 2-3 weeks, we believe there is still some attractive upside to this turnaround.

Avid Technology (AVID) makes software and hardware that ad agencies, news organizations, music producers, and other marketing and entertainment companies use to create, edit, and add effects to film, video, and audio. After a Q3 earnings warning in October, the stock tanked from nearly $9/sh to $5.87/sh. Since then the stock has formed a base or support at around $6/sh and has slowly climbed back up to $6.83/sh.We note that trading volume of this stock has tapered off since the downturn in Oct. Based on this, we do not anticipate too much further selling during the short to medium-term.